Did you know most homeowners have either HO-3 or HO-5 insurance? These policies are the most common in the U.S. They protect homes, personal items, and liability. Knowing the differences can help you pick the right policy for your budget and needs. 8 Types of Homeowners Insurance Policies to Know

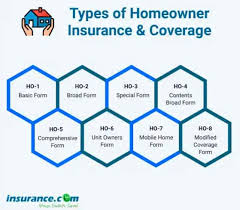

Buying homeowners insurance is crucial to protect your home and family. There are eight main types of policies. They cover your home, belongings, liability, and extra living costs. HO-3 is common and offers wide coverage. HO-5 is for those with high-value homes and items.

Key Takeaways

- Homeowners insurance is essential for protecting your home and belongings.

- The most common homeowners insurance policies are HO-3 and HO-5.

- HO-3 provides broad coverage, while HO-5 offers comprehensive protection for high-value properties.

- Understanding the different policy types can help you choose the best coverage for your needs.

- Homeowners should review their policy details to ensure they have the right level of protection.

Introduction to Homeowners Insurance Policies

It's vital to protect your home and assets with the right homeowners insurance. Homeowners insurance helps cover damage, theft, and liability. This way, you avoid big expenses. There are many policy types, each offering different levels of coverage for your home, personal property, and living expenses if your home is not livable. Knowing the differences between policy types helps you choose the best one for your needs and budget.

Importance of Protecting Your Home

Your home is probably your biggest investment. Protecting it is a top priority. Homeowners insurance acts as a safety net against unexpected disasters like fires, storms, or burglaries. It ensures you don't face huge costs for repairs or replacements. Also, many lenders require insurance before approving a loan, making it crucial for homeowners.

Understanding Policy Types and Coverage

The homeowners insurance market has many policy types, each with its own coverage options and limitations. From the basic HO-1 to the comprehensive HO-5, knowing the differences is key. Consider your home's age, condition, personal belongings' value, and liability risks when picking a policy.

| Policy Type | Coverage Overview |

|---|---|

| HO-1 (Basic Form) | Covers damage from 10 named perils, insures the home at actual cash value, and offers limited coverage. |

| HO-2 (Broad Form) | Covers the home for replacement cost and belongings for actual cash value against 16 named perils. |

| HO-3 (Special Form) | The most common type, providing comprehensive coverage for the home and open perils coverage for belongings. |

| HO-4 (Renters Insurance) | Covers loss of use, personal property, and liability for renters, but not the structure of the rented home. |

| HO-5 (Comprehensive Form) | Offers the most extensive coverage, including replacement cost for personal property and higher limits for valuable items. |

Understanding the types of homeowners insurance and the coverage they provide helps you make a smart choice. This way, you can protect your home, personal belongings, and financial well-being.

HO-1: Basic Form

The HO-1 policy is the most basic homeowners insurance. It covers your home's structure and personal items at their actual cash value. This means it considers depreciation. It only protects against 10 named perils, like fire and theft. Because of its limited coverage, HO-1 policies are not common today.

According to the National Association of Insurance Commissioners, HO-1 policies only made up 1.8% of single-family home insurance policies nationwide in 2021. This is a small fraction compared to the HO-3 policy, which covered 78.2% of homes that year.

The specific perils covered under an HO-1 basic homeowners insurance policy include:

- Fire or lightning

- Windstorm or hail

- Explosion

- Riot or civil commotion

- Aircraft

- Vehicles

- Smoke

- Vandalism or malicious mischief

- Theft

- Volcanic eruption

While HO-1 policies are cheap, they offer little protection. They are not recommended for most homeowners. This is because they don't cover many common risks.

| Policy Type | Percentage of Home Insurance Policies in 2021 |

|---|---|

| HO-1 | 1.8% |

| HO-2 | 6.7% |

| HO-3 | 78.2% |

| HO-5 | 13% |

8 Types of Homeowners Insurance Policies to Know

Dwelling and Personal Property Coverage

Homeowners insurance policies vary in what they cover. They protect your home's structure and your belongings. Some policies, like HO-1 and HO-2, only cover damage from specific causes. Others, like HO-3 and HO-5, cover all damage types, except for those not listed.

Named Perils vs. Open Perils

Named peril policies, such as HO-1 and HO-2, only cover damage from specific causes like fire or theft. Open peril policies, like HO-3 and HO-5, cover all damage types, except for those not listed.

It's important to know the difference between named peril and open peril policies. Named peril policies might be cheaper, but open peril policies offer more protection. This is key when choosing the right homeowners insurance policy types and home coverage options for you.

| Policy Type | Dwelling Coverage | Personal Property Coverage | Perils Covered |

|---|---|---|---|

| HO-1 | Yes | No | Named Perils |

| HO-2 | Yes | Yes | Named Perils |

| HO-3 | Yes | Yes | Open Perils |

| HO-4 | No | Yes | Named Perils |

| HO-5 | Yes | Yes | Open Perils |

| HO-6 | Limited | Yes | Named Perils |

| HO-7 | Yes | Yes | Open Perils (Dwelling), Named Perils (Personal Property) |

| HO-8 | Yes | Yes | Named Perils |

Knowing the different homeowners insurance policy types and their home coverage options helps homeowners make informed choices. The choice between named peril vs open peril policies depends on your needs and budget.

HO-3: Special Form

The HO-3, or special form policy, is the most common HO-3 homeowners insurance. It offers strong coverage for your home's physical structure, usually at replacement cost. Your personal belongings are covered at actual cash value. This policy also has "open perils" coverage for your home, protecting against most damage types, except for earthquakes, floods, and neglect.

This broad all-risk dwelling coverage makes the HO-3 a great choice for many homeowners.

The HO-3 policy is very versatile. It covers your home, other structures on your property, personal items, liability, and extra living costs if your home is not livable. This "special form" coverage makes the HO-3 the most common home policy for homeowners wanting full protection for their home.

In summary, the HO-3 policy is a top pick for homeowners needing reliable insurance. Its open perils coverage and replacement cost for the dwelling make it a practical choice for protecting your home and belongings.

HO-4: Renters Insurance

If you rent a place, whether it's an apartment, condo, or house, HO-4 renters insurance is key. It protects your personal stuff from 16 named perils, just like HO-2 or HO-3 policies. It also covers liability and extra living costs if your place is no longer livable.

Renters insurance doesn't cover the building itself. That's the owner's job. But it does protect your personal items from damage or loss due to accidents or disasters.

Renters insurance is cheaper than homeowners insurance. It doesn't cover building damage. So, it's a good deal for renters, offering peace of mind and financial security for your stuff.

"Renters insurance is an often overlooked but essential coverage for those who don't own their homes. It's a cost-effective way to protect your personal property and liability exposure."

Whether you rent an apartment, condo, or house, HO-4 renters insurance is a wise choice. It keeps your valuables safe and offers financial protection against the unexpected.

HO-5: Comprehensive Form

The HO-5 is the most detailed homeowners insurance policy. It covers your home's structure and personal items at full replacement cost, not just their actual value. This is different from the HO-3 policy.

High-Value Property Coverage

The HO-5 policy is great for protecting expensive items. It offers more coverage and higher limits for things like jewelry, art, and electronics. This makes it perfect for homeowners with lots of valuable stuff.

Comparison with HO-3 Policy

The HO-5 policy costs more than the HO-3, but it's worth it. It provides better protection against more risks and offers more coverage for valuable items. If you have a lot of assets, the HO-5 is the best choice for full protection.

| Coverage | HO-3 Policy | HO-5 Policy |

|---|---|---|

| Dwelling and Other Structures | Named Perils | Open Perils |

| Personal Property | Named Perils | Open Perils |

| Replacement Cost for Personal Property | Optional | Included |

| Coverage Limits for High-Value Items | Lower | Higher |

"The HO-5 policy is an excellent choice for homeowners who want the highest level of protection for their home and personal belongings, including valuable assets like jewelry and fine art."

Conclusion

Choosing the right homeowners insurance is key to protecting your home and assets. Knowing the eight main policy types helps you pick the best coverage for your needs and budget. Whether you have a single-family home, condo, or mobile home, there's a policy for you.

Think about the coverage you need for your home, belongings, liability, and extra living expenses. This helps you find insurance that gives you peace of mind. By understanding the differences between policies, you can make a smart choice for your home and belongings.

Choosing the right homeowners insurance is crucial for your home's safety. By knowing the policy types and coverage levels, you can secure your financial future. This way, you can rest easy knowing your investment is safe.