?feature=shared">?feature=shared

But before we get into the mechanics, let's talk about why so many people think $10,000 a month in passive income is out of reach in the first place. For many people, the idea of generating significant passive income feels out of reach because of persistent misconceptions and the influence of sensational headlines. Stories about wild market swings, sudden crashes, and overnight fortunes from risky trades dominate the news, making it easy to believe that steady, predictable income is a fantasy.

What's often overlooked is that these stories usually focus on speculative trading, trying to buy low and sell high based on short-term trends. This approach relies on timing the market, which is incredibly difficult to do consistently and can lead to heavy losses, especially for beginners. The result, many walk away convinced that investing is simply too risky. It's important to draw a clear line between this kind of speculation and valuebased investing. Speculative trading is about chasing quick wins and often ends in disappointment.

In contrast, valuebased investing, like dividend investing, focuses on acquiring shares in companies that have a proven track record of generating steady cash flow and returning value to shareholders. Take Coca-Cola for example. This company has paid dividends for over a century, weathering wars, recessions, and financial crisis. Dividend aristocrats like Coca-Cola aren't just lucky.

They're built on consistency and resilience. And they show that reliable passive income isn't

just for the ultra wealthy or financial insiders. Another factor that makes passive income seem unattainable is the constant stream of get-richqu promises. Ads everywhere claim you can turn a small sum into a fortune overnight. These schemes prey on impatience, making it seem like wealthb buildinging is either instant or impossible. When these quick fixes fail, they reinforce the myth that only a select few can ever achieve true financial freedom. A common mistake is jumping into a hot penny stock or a speculative asset only to see

it crash. In the rush for fast results, people miss one of the most powerful forces in finance, compounding. Compounding works quietly but relentlessly. When you reinvest dividends, your returns start to snowball. For example, in our projections, $28 a month in dividends grew to $742 a month after just 10 years. All because each payout was reinvested to buy more shares, which then produced even more dividends. This isn't about luck. It's about sticking with a plan and letting time do the heavy lifting.

A lot of the hesitation around passive income also comes from a lack of clear financial education. Many people aren't taught how long-term investing actually works. And terms like compounding or dividend reinvestment can sound intimidating, but the reality is straightforward. Companies like Microsoft have increased dividends for 20 years straight, demonstrating that there's real consistency behind these numbers. Reliable dividend paying companies reward patient investors, and the process is much simpler than it first appears. What really holds people back is the scale of the goal. Earning $10,000 a month in passive income sounds massive, especially if you're starting from scratch. It's easy to think you need millions in the bank to even get started. But the truth is you don't need to make a single giant leap. Instead, it's about breaking the journey into smaller, manageable steps and focusing on steady progress.

Discipline, patience, and a clear plan are far more important than starting with a huge amount of money. Dividend investing stands out because it offers something those quick fix schemes can't. stability and predictability. Imagine holding a portfolio of stocks that pay you cash every quarter, regardless of what the headlines say. This isn't about luck or finding the next big thing. It's about building a diversified collection of reliable businesses that create real wealth over time. Even so, skepticism remains. Earning money without active work feels

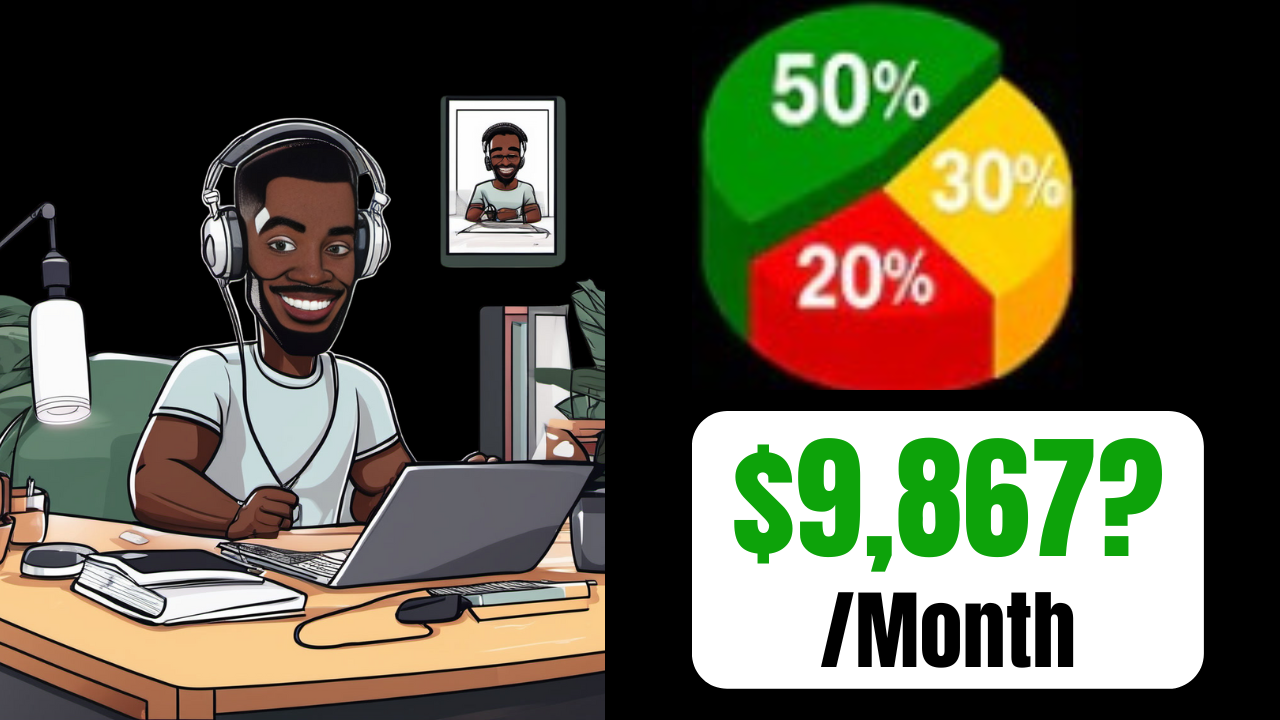

unfamiliar for most people, and that discomfort can keep them from taking the first step. The real secret to transforming passive income from an impossible dream into a realistic goal is having a plan and sticking to it. Dividend investing isn't about one big bet. It's about following a structured approach that works over the long term. The 50 3020 dividend plan takes the guesswork out of where to begin. Offering a clear framework that balances stability, reliability, and growth.

By spreading investments across different types of assets, you reduce risk and create a pathway to steady wealth building. So, how do we replace myths with a plan? Let's break down the 50 3020 approach. Building lasting passive income starts with a clear, disciplined approach. The 50 3020 dividend plan is designed to do just that, giving you a structured way to balance stability, reliability, and long-term growth in your investments. Instead of relying on a single strategy or chasing market fads, this plan uses three carefully chosen categories. Dividend focused

ETFs, dividend aristocrats, and dividend growth powerhouses. Each plays a distinct role in shaping a portfolio that generates income now and multiplies wealth over time. At the core of this strategy is diversification. By splitting your portfolio 50% in dividend focused ETFs, 30% in dividend aristocrats, and 20% in high growth dividend stocks, you reduce the risk that comes from betting everything on one investment. This structure isn't just about avoiding losses.

It's about making sure your money is always working efficiently, whether markets are calm or turbulent. Let's look at how the allocation works in practice. The largest portion, 50% goes into dividend focused ETFs. These funds offer instant diversification across many companies, protecting you from the ups and downs of any single stock. For example, SCHD focuses on highquality dividend payers with solid fundamentals currently yielding 4.03%. Alongside CHD, VYM provides exposure to America's largest dividend paying companies with a 2.86% yield. If you

invest $25,000 in each, you create a stable base for your portfolio. The combined yield from these ETFs is 3.45%, generating $1,725 in annual dividend income from the $50,000 allocated here. This segment is all about stability and steady cash flow. Next, the plan allocates 30% to dividend aristocrats, companies with a history of raising their dividends year after year. Think of Microsoft, which has grown its dividend for 20 consecutive years. Coca-Cola with an impressive 62-year streak, and Loheed Martin increasing dividends for 22 years.

Investing $10,000 in each of these stocks totals $30,000 and their combined yield is about 2.1% or $630 per year. This section of the portfolio is built for reliability. These companies have proven they can weather economic storms and still reward their shareholders, providing a dependable stream of income. The final 20 is set aside for dividend growth powerhouses. companies like Apple and Broadcom.

Their current yields are lower at 0.52% and 0.96% respectively, but they have a strong track record of increasing both their stock prices and their dividend payouts. Allocating $10,000 to each means $20,000 goes into this growth segment, which yields about 0.74% or $148 annually. While this may not seem like much at first, these companies are included for their historically strong returns and rapid dividend growth. For example, Broadcom's 10-year performance and Apple's consistent growth have both delivered meaningful long-term gains for investors. When you blend these allocations, the overall portfolio yields 2.5%.

This figure comes from the weighted averages, 3.45% 45% from ETFs, 2.1% from aristocrats, and 0.74% from growth stocks. With an initial $100,000 investment, you're looking at $2,500 in annual passive income right away, about $28 per month. But that's just the beginning. See how this becomes nearly $10,000 monthly in 30 years. The real advantage of the 503020 plan is how it leverages compounding. By reinvesting every dividend payout, you steadily buy more shares, which then generate even more dividends.

Over time, as companies increase their payouts, and your portfolio grows, your income accelerates. The starting yield of 2.5% is only the baseline. As dividends are reinvested and companies raise their payouts, the growth becomes more powerful each year. This strategy isn't about hoping for one big win. It's about building a portfolio that balances stable income, proven reliability, and future growth. By allocating $50,000 to ETFs, $30,000 to dividend aristocrats, and $20,000 to growth stocks, you set yourself up for both immediate returns and long-term wealth multiplication. Each segment works together, so you're never relying too much on any one part of the market. Now, with this structure in place, the next step is to see how these pieces work together over time. What can you actually expect if you stick with the plan for 10, 20, or even 30 years? The results might surprise you.

?feature=shared">?feature=shared

Let's chart the path of a $100,000 investment using the 503020 dividend plan over 30 years and see how it can

evolve into a multi-million dollar portfolio. This isn't about overnight success or wild speculation. It's about disciplined investing, steady reinvestment, and the natural force of compounding returns. The numbers behind this approach are grounded in historical data and the long-term performance of quality dividend paying companies and funds.

So, what if I told you your $100,000 could more than triple in just 10 years? By consistently reinvesting every dividend payout, you steadily acquire more shares, and those new shares generate additional dividends. This cycle is what drives true compounding growth. After a decade of following this plan, your portfolio could reach $356,346. At this point, your monthly dividend income would be around $742. The growth may feel gradual at first, but it sets the stage for much more dramatic gains as you move forward. Now, imagine sticking with the plan for another 10 years. What could your investment look like after 20 years? The compounding effect accelerates and your portfolio is projected to grow to 1,269,822.

That's more than 12 times your original investment. your monthly passive income would rise to about $2,645, creating a meaningful new source of cash flow. This is the power of patience and staying invested through market cycles. But the real transformation happens in the final stretch. What if you let that compounding engine run for the full 30 years? The projections show your portfolio reaching $4,524,954. At this level, your annual dividend income would be approximately $113,124 or about $9,427 every month. This amount not only rivals but can surpass the median household income in the United States, illustrating just how powerful a disciplined dividend plan can be over the long haul. You might wonder how these numbers are possible, especially starting with a yield of just 2.5%. The answer comes down to the combined effect of dividend reinvestment and capital appreciation.

The 13.55% annualized return reflected in these projections is a blend of both dividend income and the historical growth rates of assets like SCHD, VYM, Microsoft, Apple, and Broadcom. These companies and funds have demonstrated a consistent ability to reward shareholders even through periods of market volatility. Their regular dividend increases add another layer of growth as higher payouts mean more money to reinvest each year. A key element of this strategy is the regular increase in dividends from many of the companies in your portfolio, especially the dividend aristocrats.

Take Coca-Cola for example. It has raised its dividend for over 60 years in a row. These increases mean that over time your income stream doesn't just keep up with inflation, it grows well beyond it. That's why reinvesting dividends is so powerful. Each increase in payout gives your compounding cycle another boost, accelerating both income and total portfolio value. The 5030 allocation also plays an important role in balancing growth and stability. The ETFs anchor your portfolio with broad diversification and steady yields. The dividend aristocrats provide reliability with their long histories of consistent payouts. The growth stocks might start with lower yields, but their potential for capital appreciation and rapid dividend growth becomes increasingly important in later years.

Together, these segments ensure your portfolio is built to weather market fluctuations while still aiming for strong long-term results. It's understandable to feel skeptical when you see projections like $4.5 million and nearly $10,000 a month in passive income, but these figures don't rely on luck or market timing. They're the result of sticking to a plan, reinvesting every dividend, and giving your investments time to work. The real driver here isn't the size of your initial investment, but your consistency and patience over the years. These projections look exciting, but no strategy is without hurdles.

Let's examine the risks next. Every investment strategy has trade-offs, and dividend investing is no exception. The 503020 plan offers a clear path to building passive income, but it's important to recognize the risks and realities that come with it. Understanding these challenges upfront helps you set realistic expectations and build a portfolio that can stand the test of time. One of the most immediate risks is market volatility. When the market drops, the value of your portfolio can decline, sometimes sharply. Even a diversified approach like the 503020 plan can't insulate you from all short-term losses. During events like the 2007208 financial crisis or the 2020 pandemic,

stock prices fell across the board.

However, while your portfolio's value may fluctuate, the income from dividends often remains more stable. Many dividend focused companies, particularly those in aristocrat category, have a track record of maintaining or even increasing their payouts during downturns. This consistency is a key reason why dividend investing appeals to those looking for steady income. Still, dividends are never guaranteed. Economic hardship can force companies to reduce or suspend their payouts. The 2007 to 2008 crisis saw major banks cut or eliminate dividends, disrupting income streams for many investors. During the 2020 pandemic, several companies, especially in hard-hit sectors, temporarily reduced or halted dividends to preserve cash. These moments serve as reminders that even the most reliable income streams can face disruption.

This is where diversification becomes critical. The 503020 plan spreads your investments across dividend focused ETFs, dividend aristocrats, and growth stocks. ETFs like CHD and VYM, for example, hold shares in hundreds of different companies. So, if one company cuts its dividend, the impact on your overall income is minimized. This broad exposure helps stabilize your income even if a few holdings stumble. Meanwhile, the inclusion of dividend aristocrats, companies like Coca-Cola, which has increased its dividend for 62 consecutive years, and Loheed Martin with a 22-year streak, adds another layer of reliability. These companies have demonstrated resilience through

recessions, market crashes, and global disruptions, making them cornerstones for income focused investors. Quality matters just as much as diversification. The 503020 strategy emphasizes investing in companies with strong cash flow and a proven history of raising dividends.

These aren't just businesses that pay dividends. They prioritize them, often making dividend growth a central part of their financial strategy. Focusing on such companies increases your chances of maintaining a stable income even when markets are rough. But it's also important to remember that no company is immune to change. Even the most consistent dividend payers can face challenges, which is why ongoing monitoring and a willingness to adjust your holdings are essential parts of the plan. Another reality to keep in mind is that past performance doesn't guarantee future results. Companies that have raised dividends for decades could encounter unforeseen difficulties. That's why a long-term mindset and flexibility are crucial. The 50-30-20 plan isn't about predicting which stock will always perform best.

It's about building a framework that can adapt as conditions change. If a dividend cut occurs in one area of your portfolio, diversification helps cushion the blow, and reinvesting dividends allows you to regain momentum over time. Patience and consistency are what set successful dividend investors apart. This strategy isn't about chasing quick wins or reacting to every market headline. It's about sticking to the plan, reinvesting dividends, staying

diversified, and focusing on quality over hype. Even during periods when stock prices are flat or declining, the income from dividends continues to flow, helping you stay on course and weather the inevitable downturns. Ultimately, every investment carries some risk. The goal isn't to eliminate risk entirely, but to manage it wisely through a disciplined, diversified approach by combining stability, reliable dividend growers, and growth powerhouses.

The 503020 strategy weathers market storms while building wealth. And with a clear understanding of both the risks and the rewards, you're better prepared to pursue your long-term financial goals with confidence. Financial freedom through $10,000 a month in passive income isn't just a distant dream. It's a practical goal for anyone willing to combine discipline with time. The 503020 strategy shows how steady investment habits and a diversified approach can transform $100,000 into a portfolio generating over $9,400 in monthly income within 30 years. We've seen how these results are possible by blending stability, reliability, and growth. The best time to start dividend investing was 20 years ago. The next best time is now. Every year you wait is a year compound growth isn't working for you. If you're ready to start, comment below which bucket you'd fund first, and hit subscribe for weekly dividend insights. Now, it's your turn to make your money work harder.