The car buying process is often filled with hidden fees and deceptive tactics. These can lead to high interest rates that trap people in debt. Edmunds.com found that about 40% of new car buyers still owed money on their old car. Car Loans Are A RIP Off: Avoid These Traps

The average remaining balance after trading in the old car was over $5,000. Dealerships often add this balance to the new car loan. This can extend the time you spend making payments, leading to more interest and being underwater on the new loan.

The best approach is to spend the least on a car that meets your needs. Finance it for as short a time as possible. Then, keep driving the car for many years after it's paid off.

Key Takeaways

- Beware of predatory lending practices and high interest rates on car loans

- Avoid hidden fees and deceptive auto loan tactics that can lead to exorbitant car loan costs

- Research vehicle pricing and the true value of your trade-in before visiting the dealership

- Be cautious of exploitative car financing schemes and unfair loan terms

- Minimize credit inquiries during the car shopping process to avoid ripoffs in the auto loan industry

Dealers Can Inflate Vehicle Prices

When looking for car loans, it's key to research vehicle prices before visiting a dealership. Dealerships often raise car prices to make more money, targeting buyers who don't know better. Knowing the car's true value helps you avoid these high prices and get a better deal.

Research Vehicle Pricing Before Visiting the Dealership

Before going to the dealership, find out the car's fair market value. Websites like Kelley Blue Book, Edmunds, and NADA Guides can help. They use recent sales data to give you accurate prices. This info lets you negotiate better, so you don't pay too much.

Know the True Value of Your Trade-In

It's also important to know your current car's trade-in value. Dealerships might offer low prices to make more money. Knowing your car's worth helps you negotiate a better deal. Use the same online tools to find your trade-in's value and use it to your advantage.

Being informed helps you confidently navigate the car-buying process. It keeps you away from car loans are a rip off and auto financing scams that come with high prices and unfair trade-in values.

"Knowledge is power when it comes to negotiating the price of a vehicle. Do your research, and you'll be in a much better position to get a fair deal."

Beware of Interest Rate Markups

When it comes to car loans, the interest rate matters a lot. Sadly, many dealerships use auto financing scams by raising the interest rates. This can cost buyers hundreds or thousands of dollars over time.

Dealerships might use a "auto-enhanced credit report" to set the interest rate. This can make a big difference, even with just one late payment. A single late payment can raise the interest rate by 2-3%. This leads to exorbitant car loan costs for the buyer.

Let's look at an example. A $20,000 car loan at 6% interest for 60 months costs $386.66 a month. But, if the rate goes up to 8.5%, the monthly payment jumps to $410.33. This adds up to an extra $1,420 in costs over the loan term.

Buyers need to watch out for these interest rate markups and hidden fees in car financing. To avoid predatory lending practices and exploitative car financing schemes, it's smart to shop around. Find the best financing options before you go to the dealership.

"Dealers may receive prizes and incentives from finance companies for driving business their way, leading to unfair car loan terms and deceptive auto loan tactics."

By staying informed and careful, car buyers can avoid the ripoffs in the auto loan industry. They can make sure they get a fair deal on their car loans.

Car Loans Are A RIP Off

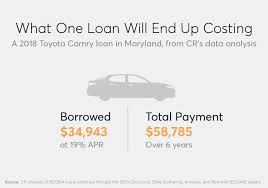

Car loans can be a bad deal for many, thanks to high interest rates and predatory lending. Experian found that those with lower credit scores face much higher rates. For example, those with scores between 300 and 500 pay an average of 15.77% for new cars. This is compared to 9.83% for those with scores between 601 and 660.

These high costs can make the loan much more expensive over time.

Predatory Lending Practices

Without federal limits on interest rates, consumers are at risk of predatory lending. A Consumer Reports study revealed some lenders charge as high as 75% APR. This can lead to a cycle of debt, making it hard for borrowers to get out.

High Interest Rates on Car Loans

Those with poor credit should look for better deals. Getting pre-approved or finding a co-signer can help. The Federal Trade Commission has a new rule to fight these unfair practices, starting in July 2024.

In 2017, 107 million Americans had car loan debt, which is about 43% of adults. The average car payment is $523/month. With 76% of Americans living paycheck to paycheck, these loans can be a huge financial strain.

Minimize Credit Inquiries During Car Shopping

When looking for a car, it's key to keep credit inquiries low. Too many can hurt your credit score. Before you go to a dealership, think about getting pre-approved for a loan from a reliable lender. This way, you can look for cars like you're paying cash, avoiding many credit checks.

FICO says one hard inquiry can drop your score by less than five points. Also, having six or more inquiries on your report can make you eight times more likely to file for bankruptcy. Only 5% of your Vantage Score 3.0 comes from recent inquiries, Vantage Score notes.

The FICO loan shopping window is 45 days for comparing rates. VantageScore limits it to 14 days. Hard inquiries can affect your score for a year but stay on your report for two. By keeping credit inquiries low, you protect your score and get better loan terms.

"Protecting your credit score is crucial when shopping for a car. By getting pre-approved and minimizing credit inquiries, you can avoid unnecessary credit checks and secure better financing terms."

Overpriced Add-Ons and Hidden Fees

When you get a car loan, the cost is more than just the price and interest rate. Dealerships often use auto financing tactics to sell you extra products and fees. These can make your loan much more expensive.

Exorbitant Costs for Optional Products

Dealerships might push for extras like Guaranteed Auto Protection (GAP) insurance and credit life and disability insurance. These can cost a lot more than if you bought them elsewhere. For example, GAP insurance usually costs about $100 a year. But dealerships might charge $300 or more for the same thing.

VIN etching is another example. It can cost $150 to $300 at a dealership. But you can do it yourself for just $20 with an online kit. It's important to watch out for these exorbitant car loan costs and find better deals.

Deceptive Auto Loan Tactics

Dealerships might also add hidden fees like application fees, processing fees, and documentation fees. These can add hundreds or thousands of dollars to your loan. These fees are often not clearly explained upfront.

It's crucial to read the fine print and talk about any fees you're unsure about. Knowing the laws and standard practices in your area can help you spot unfair car loan terms and deceptive auto loan tactics. Being informed and proactive can help you avoid these ripoffs in the auto loan industry and get a better deal.

Benefits of Getting Pre-Approved

When it comes to car loans, being smart is crucial. You want to avoid ripoffs, scams, and predatory lending practices. Getting pre-approved from a trusted lender, like a credit union, is a smart move. Do this before you go to the dealership.

Avoid Dealer Financing Traps

Getting pre-approved has many benefits. It lets you shop like a "cash" buyer. This gives you more power to negotiate the price of the vehicle. Dealers know you've already got financing, so they're less likely to use high-pressure financing tactics.

With pre-approval, you can focus on getting the best price. You'll avoid the pitfalls of dealer-arranged financing. This includes hidden fees, unfair loan terms, and exorbitant costs. It also keeps you away from deceptive auto loan tactics and exploitative car financing schemes in the auto loan industry.

Industry data shows pre-approval APRs for auto loans range from 5% to 29%. The best rates go to those with a credit score of 720 or higher. By getting pre-approved, you can compare offers. This way, you might get better loan terms that save you money.

Exploitative Car Financing Schemes

The car loan industry is filled with schemes that trap buyers in bad deals. The "buy-here, pay-here" model targets those with poor credit. These lenders charge high interest rates, hide fees, and even track vehicles for easy repossession.

In New Mexico, car loans can have up to 175 percent APR. Oregon lets dealerships charge more than 36 percent. Seven states have no limits on auto loan interest rates.

- Over 875,000 borrowers in the US got loans with high APRs in the last decade.

- South Carolina lets lenders charge more than 18 percent, with one loan at 49 percent APR in 2012.

- Massachusetts has sued auto lenders for breaking usury laws by not including all costs in APR.

Buyers need to watch out for predatory lenders. Look for reputable financing options like credit unions or online lenders. They offer reasonable terms for those with bad credit.

"Synthetic identity fraud in the auto finance industry leads to around $50 billion in losses according to the Aite Group."

Shorter Loan Terms Save Money

Financing a new car can be costly, and the loan term plays a big role. Longer loans may seem cheaper each month, but they cost more in interest over time. It's smarter to choose a shorter loan, even if it means paying more each month.

Pay Off Loans Quickly to Build Wealth

Going for a 36-month or 48-month loan helps you pay off your car faster. This saves you thousands in interest and lets you use that money elsewhere. Avoiding the cycle of never-ending car payments is crucial for financial stability and growth.

| Term | Monthly Payment | Total Interest Paid |

|---|---|---|

| 36 months | $1,226 | $4,135 |

| 48 months | $949 | $5,533 |

| 60 months | $783 | $6,959 |

| 72 months | $672 | $8,413 |

The table shows that while a 72-month loan might be cheaper monthly, it costs more in interest. Choosing a shorter loan term is the key to minimizing your car loan costs and building wealth.

"Choosing a short-term 36-month loan can result in nearly double the monthly payment compared to a 72-month term, but can save over $1,500 in interest over the loan's life."

Auto Financing Scams to Watch Out For

The auto financing world is full of scams and unfair practices. These can lead buyers into bad deals and long-term debt. One trick is the "buy-here, pay-here" model, aimed at those with poor credit. Dealers offer loans with high interest rates and hidden fees, sometimes even GPS tracking for easy repossession.

Be cautious of dealers pushing expensive extras like GAP insurance and credit life/disability coverage. These add-ons can greatly increase the loan cost, making it hard to pay off the vehicle. Some dealers might also use tricks like interest rate markups and rolling over old loans into new ones, making things worse financially.

- The Federal Trade Commission plans to implement the Combating Auto Retail Scams (CARS) Rule to address car loan scams, limiting excess fees and banning misleading promotions on car prices and auto loan rates.

- Repossession can occur after just two or three months of non-payment, emphasizing the importance of early communication with the lender to explore payment options.

- Yo-yo financing scams target consumers with bad credit or no credit profile, and it is stated that yo-yo financing is illegal in every state.

- The Federal Trade Commission has focused on dealers handling negative equity improperly and dealers not clearly explaining how negative equity affects new auto loan balances, leading to administrative actions.

To dodge these auto financing scams, do your homework on vehicle prices and trade-in values before visiting the dealer. Also, get pre-approved financing from banks or credit unions. By being informed and careful, you can get a good auto loan deal and avoid the predatory lending practices common in the industry.

| Statistic | Details |

|---|---|

| Interest Rate Caps | At least 32 states plus the District of Columbia cap interest rates at 36% or less for $2,000 installment loan products. However, lenders may charge interest rates exceeding 100% in car title loan scams. |

| Cosigner Scams | Victims of a cosigner scam end up with the entire loan in the cosigner's name. |

| Payday Loan Interest Rates | 18 states and the District of Columbia have an interest rate cap of 36% or lower on payday loans. |

| Reporting Unfair Terms | Consumers with unfair auto loan terms can file complaints with the Consumer Financial Protection Bureau. |

"Staying informed and avoiding these common traps is key to securing a fair and affordable auto loan."

Conclusion

Car loans can trap many consumers with predatory lending practices, high interest rates, and hidden fees and add-ons. It's crucial for buyers to be careful and do their homework. They should know their trade-in's value, limit credit checks, and get pre-approved financing from a reliable lender before visiting a dealership.

Choosing shorter loan terms can save money and help build wealth. The average auto loan for new cars is over 68 months. Almost 70% of buyers opt for loans of 61 months or more. This can lead to higher interest costs and the risk of owing more on the loan than the car's value.

To dodge ripoffs in the auto loan industry and exploitative car financing schemes, consumers need to watch out for deceptive auto loan tactics and exorbitant car loan costs. By understanding their vehicle's true value, buyers can better navigate the car buying process. This helps protect them from auto financing scams and car loans are a rip off traps.

Health: https://bodmelt.com

Mobile Tech https://earnessential.com

Security https://bellpeek.com

Kids https://totpeek.com

Personal Finance: https://erneroy.com