You’ll learn a clear, step-by-step guide that helps you spot the scripts and habits keeping you stuck. Experts like Jeri Bittorf and Kalee Boisvert point out that fear-driven thinking often persists even when your numbers show stability. This guide balances emotion and action. It explains why perceived lack can feel real, how anxiety and overthinking feed risk-averse choices, and which simple routines shift your view of money into one of options and security. Expect practical moves that separate facts from fiction using real figures, plus quick habits—gratitude, simple planning, and systems—that you can repeat. Many people, including successful ones, face this issue. The aim is skill-building, not blame.

Key Takeaways

- Identify thought patterns that cause chronic stress and limited choices.

- Use real numbers to separate fear from fact and restore perspective.

- Pair emotional work—gratitude and reframing—with practical systems.

- See money as a tool for options and security, not a verdict on worth.

- Skill-building beats shame; progress comes from repeatable actions.

Understanding a scarcity mindset and why it feels so convincing

First, learn to catch the mental loop that tightens your choices even when your finances are steady. This is less about facts and more about automatic thinking that focuses on threats instead of options.

Scarcity thinking vs. normal scarcity in real life

Real scarcity means limited resources—time, cash, or supplies—in the present moment. Mental scarcity keeps running after the danger passes.

Common “I’ll never have enough” scripts

You might hear inner lines like “I’ll never have enough,” “I should be doing more,” or “I’m terrible with money.” These background scripts nudge decisions toward short-term safety rather than long-term gains.

How fear and anxiety distort your view of money, time, and security

Fear and anxiety make risks look larger and your capacity smaller. When you feel rushed by time or worried about security, you choose quick fixes that reinforce the sense of lack.

Notice these patterns so you can test choices against facts instead of feelings. The next section helps you spot when fear is driving a decision.

Spot the signs you’re making money decisions from fear, not facts

Start by spotting the moments when anxiety, not evidence, shapes your money choices.

Overthinking, hoarding, and risk avoidance: Notice if you spiral into worry before checking your accounts. If you hoard cash or refuse reasonable risk despite an emergency fund and steady bills, that’s a behavioral tell. Practitioners report common lines like “I’m scared I’ll never be able to retire” and “I should be doing more.”

When self-worth leaks into jobs, partners, and home life

Playing not to lose often looks responsible. Yet it can keep you stuck in low-paying roles, settling in relationships out of fear, or choosing safe living situations that don’t fit you.

The hidden cost: chronic stress and lowered wellbeing

Chronic stress from these patterns causes decision fatigue, sleep loss, worse health habits, and a constant sense that your life is on hold.

Quick self-check you can use now

Before a choice, ask: What facts do I have? vs. What story am I telling? This simple test helps you separate feelings from the situation.

Many people show these signs after a financial shock or during high-pressure seasons. If this sounds familiar, consider this as a signal, not a verdict, and explore ways to change the underlying stories—see a useful perspective in shift that unlocks success.

Where scarcity mindset comes from and how it forms over the years

Your earliest money memories quietly set the default rules your brain follows when choices feel risky. Those early scenes shape what safety means and whether you expect abundance or lack.

Childhood experiences often lock in simple rules: save everything, hide spending, or equate worth with earnings. Family dynamics — spoken rules about debt orunspoken signals about status — can follow you for years and shape everyday thinking.

Stories you pick up from others

You also absorb stories from friends, parents, coworkers, and media. Hearing others struggle with rent or food can make those outcomes feel inevitable for you. Over time, these stories become part of your inner script.

Setbacks, culture, and brain bias

Personal setbacks — job loss, medical bills, or divorce — hard-wire vigilance. Cultural pressure and comparison make lack feel normal when success is framed as scarcity. Then cognitive bias kicks in: once your brain expects scarcity, it notices threats and ignores stability.

- Early memories set default safety signals.

- Family rules guide money habits for years.

- Stories from others can become your own expectations.

Choice still matters: your past shaped your mindset, but deliberate practice can rewrite those defaults. For another practical perspective, see this break free perspective.

Scarcity trauma and its ripple effects on your life

When basic needs go unmet over time, your reactions harden into habits that protect rather than serve you. This pattern—often called scarcity trauma—changes how you see risk, safety, and success in daily life.

Financial instability and the habit of bracing for the worst

Financial patterns show up as hypervigilance: over-saving without a plan, reluctance to invest, and constant anxiety about collapse.

Emotional deprivation and feeling undeserving of support

When care was scarce, asking for help feels risky. You may believe you do not deserve reliable support, which narrows relationships that could help you grow.

Career limitations that keep you playing small at work

At work, risk feels intolerable. That can mean staying underpaid, refusing leadership, and missing chances that lead to greater success.

Social isolation, comparison, and the belief that you don’t belong

Scarcity thinking fuels “I don’t belong” stories. You withdraw, compare yourself to others, and weaken bonds that might bring clients, mentors, or friends into your life.

- Compassionate note: these strategies learned survival. You can update them without blame.

- Next, consider a quieter driver: time scarcity, which often deepens money lack and anxiety.

How time scarcity quietly fuels money scarcity

Running out of time nudges you toward quick fixes that cost more over the long run.

Time is often the scarce resource that shapes every choice. When you feel stretched, your thinking goes short-term. That makes you focus on what solves the moment—not what protects your future.

Overpaying for convenience when you feel stretched thin

You may stick with costly advisors, pay premium delivery fees, or buy rushed services because research feels impossible. Those steady fees add up and quietly reduce options later.

Deferring critical decisions like investing, taxes, and estate planning

Putting off investing or tax planning feels easier today, but small delays compound. Even if your income is solid, ignoring these choices can create bigger moneyproblems over time.

Impulse spending to “buy back time” and reduce stress today

Outsourcing tasks or upgrading purchases can relieve stress now. Yet repeatedly paying for speed can become an anxious loop that drains resources and limits future opportunities.

- Why time constrains everything: urgent life and work tasks crowd out planning.

- Worthwhile swaps: hire help for complex, high-value tasks (tax prep) but research routine services to avoid recurring fees.

- Scarcity-driven traps: sticking with expensive providers for convenience, deferring estate tasks, impulse buys under stress.

| Common Time-Driven Choice | Short-Term Benefit | Long-Term Cost |

| Keep pricey advisor without review | Saves time searching | Lost returns or higher fees over years |

| Delay tax planning | Avoids immediate complexity | Higher taxes and missed deductions |

| Impulse "buy back time" services | Reduces short-term stress | Recurring expense that limits options |

Reclaiming small blocks of time creates room for calm thinking and better decisions. Start with one hour a week for planning. For more perspective on shifting habits, see this practical guide at ways to shift out of scarcity.

The scarcity mindset trap even high earners fall into

Earning well doesn't stop old survival habits from shaping how you spend, save, and value your days. Even when your bank balance looks healthy, fear can nudge choices that feel safe but limit options.

Hoarding cash instead of investing with a plan

People often stash large sums in low-yield accounts seeking certainty. That cash sits idle while inflation erodes buying power.

Without a clear plan, avoiding markets replaces strategy with hope. This behaviour cuts off future opportunities and long-term success.

Overworking and under-living: delaying life until “someday”

You may trade evenings and weekends for extra income. Work fills your hours, but living waits for a target number that never feels quite right. That trade costs more than dollars. It drains your energy and narrows chances to enjoy relationships and personal growth.

Frugality that no longer makes sense and drains your energy

Cutting tiny costs can feel smart, yet hours spent chasing discounts can waste far more time and energy than the savings deliver.

Abundance here means using money with intention—funding what matters, protecting time, and creating resilience.

- Measure trade-offs in time and energy, not just dollars.

- Spot cash-hoarding, needless work, and joyless frugality as signals, not virtues.

- Seeing these patterns opens the door to practical steps that restore options and bring real abundance and opportunities.

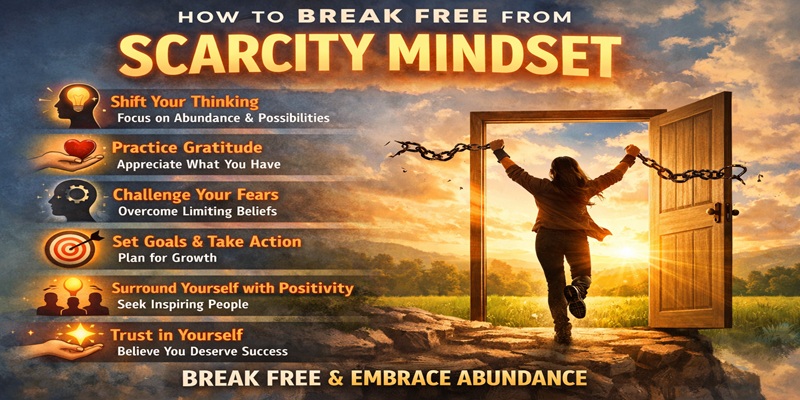

How to break free from a scarcity mindset and build financial confidence

Use clear numbers and short routines to turn anxious thinking into steady choices.

Separate facts from fiction

Check your numbers: list bills, mortgage/rent, debt minimums, and emergency fund months. If those cover today’s needs, name the fear as an old story rather than a current emergency.

Practice gratitude for concrete resources

Focus on specifics: skills you own, steady income streams, helpful tools, and people who support you. A short daily note about these items shifts attention from lack to available resources.

Reframe language and use mindfulness

Swap "I’m terrible with money" for "I’m learning to manage money." Pair that with brief mindfulness checks to curb future-tripping and lower decision anxiety.

Choose your environment and give back

Surround yourself with mentors and peers who normalize planning and asking for support. Planned generosity—small donations or sharing expertise—reinforces abundance without harming your stability.

| Tactic | Short action | Immediate impact |

| Safety check script | List monthly essentials and emergency months | Calms panic; shows current safety |

| Concrete gratitude | Write three specific resources daily | Shifts focus to abundance |

| Mindful pause | One 3-minute breathing break before big choices | Reduces anxiety; improves clarity |

| Reframing language | Use growth phrases about money | Builds confidence; reduces shame |

| Planned giving | Monthly small donation or pro bono hour | Reinforces that there is enough to share |

Get to the root with journaling that uncovers your money patterns

A short daily page can reveal the small triggers that push you toward panic spending or freezing. Journaling slows you down so you see when reactions come from habit rather than present facts.

Prompts about early security

Start small: note your earliest memory about bills, debt, saving, and what "being safe" looked like in your home. Jeri Bittorf recommends beginning around age five to find the rules you learned about security.

Family conflict and fitting in

Write about money arguments, secrecy, or times you felt you didn’t fit in at school. These scenes often shape beliefs about control, trust, and looking successful.

Find the old story and track feelings

Name the script that shows up when you feel unsafe—like "I’ll never have enough" or "I’ll never make it." Then log repeating feelings (panic, guilt, urgency, numbness) and the behaviors they trigger.

| Prompt category | Sample question | What to watch for |

| Early security | What did "safe" mean in my childhood? | Beliefs about bills, saving, and risk |

| Family conflict | Were there money fights or secrecy? | Patterns of control or shame |

| Fitting in | Did I hide spending or compare? | Pressure to appear successful; spending triggers |

Weekly review: set one short session to spot patterns before they steer decisions. This practice helps clients shift mindset and makes later systems work easier to keep.

Build financial confidence with simple systems you can stick with

Small, repeatable routines give you a steady sense of control over money and choices. Systems reduce friction when time is tight and help you act from facts, not fear.

Budgeting that reduces fear without removing joy

Use a values-based budget. Plan for essentials, savings, and guilt-free spending so you do not rely on willpower alone.

This approach protects joy while keeping goals realistic and steady.

Tracking your money to replace dread with clarity

Do a weekly check-in and quick category snapshot. Small reviews replace dread with clear data that guides sound decisions.

Break big goals into steps you can act on this week

Pick one automatic transfer, one account review, and one scheduled call. Tiny wins create momentum and show you can meet larger goals.

Make tough choices with support

When cutting expenses or changing jobs, use accountability partners or a fee-only planner. Seeking help is a practical strategy, not a weakness.

| System | Mini step this week | Immediate benefit |

| Values-based budget | Allocate one guilt-free category | Reduces fear; preserves joy |

| Weekly tracking | 10-minute category snapshot | Creates clarity; informs decisions |

| Goal micro-steps | Set one automatic transfer | Builds momentum toward goals |

| Support plan | Schedule one consult or check‑in | Less overwhelm; practical advice |

Minimum viable plan: keep the core system light in busy times so habits last. Over time, repeated wins change your sense of what you can handle and open new opportunities.

Shift from scarcity to abundance with goals, vision, and aligned spending

Picture a practical version of your future self and let that image guide spending and goals. A clear vision moves choices toward possibility rather than protection. It helps you spot opportunities and resources you once missed.

Vision boards and defining your abundant future self

Use a vision board to make success feel real. Add images and short labels that show what your life will look like: health, time freedom, meaningful work, close relationships, and financial safety margins.

Align spending to what you value

Allocate money so essentials and emergency funds stay safe, then fund what matters. This shifts default saving or avoidance into intentional action.

Use growth-oriented goals to expand resilience

Set goals that widen options: new skills, health investments, and networks. These resources increase opportunities and reduce reliance on one income path.

| Focus | Practical sign | Measure of success |

| Vision | Vision board with 5 items | Monthly review of progress |

| Spending alignment | Budget for values plus savings | Stress and sleep quality |

| Growth goals | One skill course or network action | New income or opportunity count |

Conclusion

Finish by naming one practical change that makes facts louder than fear in daily life. See the core shift: stop treating the mindset of lack as truth and treat it as a pattern you can observe and change. Recognize common scripts, spot fear-driven behaviors, trace root causes, address time pressure, then layer simple tools with steady systems. Start today with numbers: list essentials and emergency months so your money choices match facts not feelings. Keep short journaling to notice "never enough" scripts and replace them with gratitude or reframing. Choose one system (budgeting, tracking, weekly check-in) plus one practice (gratitude, reframing, mindfulness). If past trauma or chronic stress shapes your patterns, seek professional support. Your time, energy, and resources can align across the year so abundance guides real decisions and life opens to more opportunities.