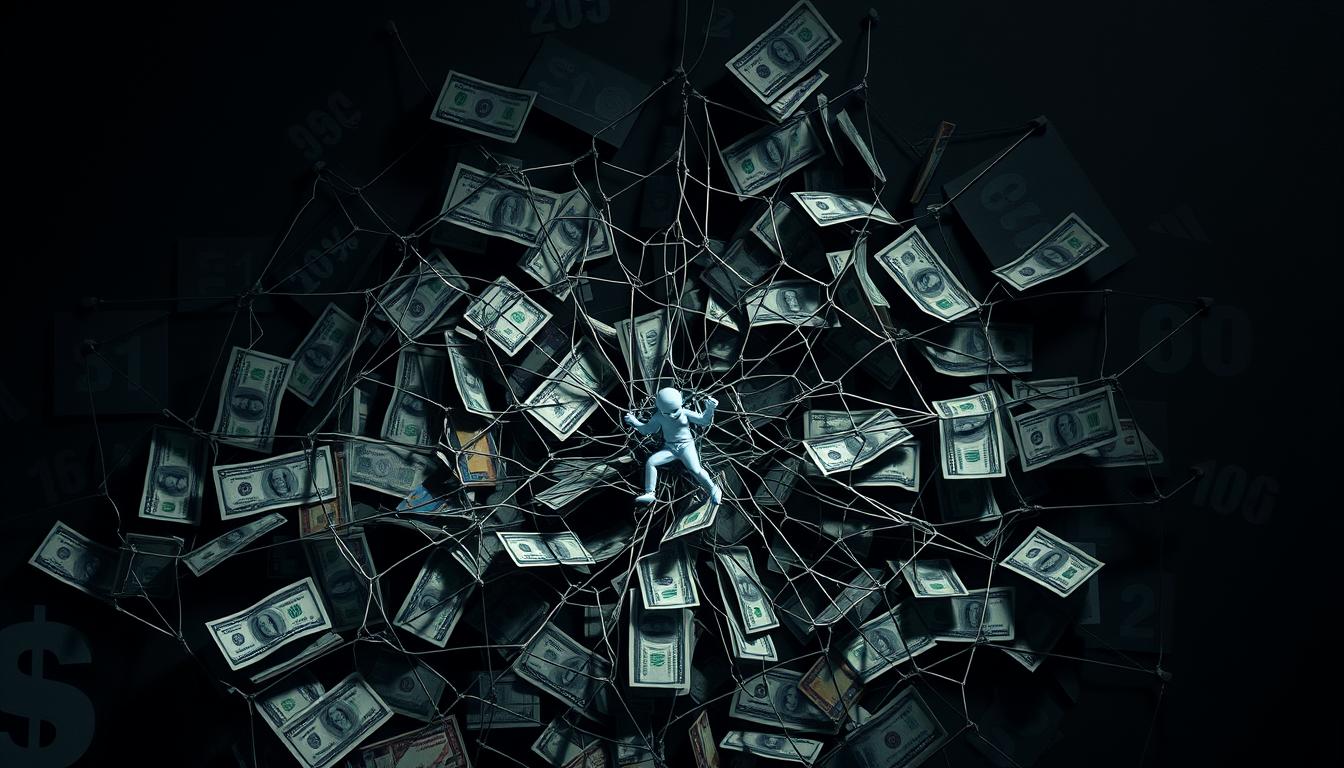

Did you know the average American household has over $6,000 in credit card debt? This shows how common the consumer credit trap is. It affects millions of people and families. But, there are ways to get out of this trap and take back control of your money, Escaping the Consumer Credit Trap: Smart Money Moves: Guide.

In this guide, we'll look at why the consumer credit trap is a problem. We'll also talk about its effects and how to escape it. You'll learn practical steps to break free from this financial challenge.

Key Takeaways

- The consumer credit trap is a widespread financial concern driven by factors like the convenience and immediacy of credit cards, as well as psychological behaviors and social influences.

- Understanding the underlying issues, such as instant gratification, social pressures, and lack of financial literacy, is crucial in addressing and breaking free from the cycle of credit card debt.

- Developing effective budgeting and money management skills, seeking professional credit counseling, and exploring legitimate debt relief options can help you escape the consumer credit trap.

- Vigilance against predatory lending practices and scams is essential to protect your financial well-being and credit score.

- Addressing specific challenges related to mortgages, auto loans, and student debt can further strengthen your path to financial freedom.

Understanding the Consumer Credit Trap

The desire for instant pleasure and the need to keep up appearances can trap people in debt. Credit cards, in particular, make it easy to spend impulsively. This can lead to a heavy debt load.

Instant Gratification and Credit Cards

Credit cards let you buy things right away, without cash. This instant pleasure can make you feel good. But, it often hides the long-term financial damage, leading to more debt.

Social Influences on Spending

Social media and peer pressure also push people to spend more. Seeing others' fancy lives can make you want to keep up. This emotional spending can trap you in debt.

Knowing why we fall into debt is key to getting out. Recognizing the lure of instant pleasure, social pressure, and emotional spending helps. This knowledge empowers us to take control of our finances and avoid debt.

The Cycle of Credit Card Debt

Credit cards offer instant gratification, but they can lead to a cycle of debt. Small debts can grow over time. High interest rates and minimum payments that mostly cover interest make it hard to pay off the debt.

Escalation of Small Debts

Americans now owe $1.08 trillion on credit cards, a 40% increase in two years. Almost half of people use credit cards every month. And 56 million have been in debt for over a year.

The Role of Interest Rates and Minimum Payments

The average credit card rate has hit a record high of over 20%. This is due to the Federal Reserve's rate hikes. Paying the minimum on a $6,088 balance would take over 17 years, costing over $9,072 in interest.

| Metric | Value |

|---|---|

| Total Credit Card Debt | $1.14 trillion |

| Average Credit Card Balance | $6,088 |

| Time to Pay Off Minimum Payments | Over 17 years |

| Total Interest Paid | Over $9,072 |

| Average Credit Card APR | Over 20% |

High interest rates and minimum payments that mostly cover interest create a debt cycle. It's hard for people to get out of this trap.

Psychological Impact of Mounting Debt

Dealing with growing credit card debt can really take a toll on your emotions. As the amount owed grows, so does the stress and anxiety. People often feel hopeless, leading to more credit card use, making the problem worse.

Credit cards make it easy to make small purchases that add up to big debt. Friends and social media can also push people to spend more than they can afford. Not knowing or ignoring your financial situation can make things even worse.

Research shows debt can harm your mental and physical health. It can lead to depression, anxiety, and even health problems like high blood pressure and obesity. Short-term loans with high interest rates can trap people in a cycle of debt and stress.

"The mounting debt often leads to stress, anxiety, and a sense of hopelessness, especially as the debt seems to grow despite efforts to control it."

It's important to tackle the emotional side of debt to break the cycle. Creating SMART financial goals and getting help from credit counselors can help. These steps can help you feel more in control and reduce the emotional weight of debt.

| Negative Impacts of Debt | Potential Health Consequences |

|---|---|

| Debt stress | Depression, anxiety, poor psychological well-being |

| Financial anxiety | High blood pressure, obesity, foregone medical care |

| Hopelessness | Lower life expectancy, child behavior problems |

Budgeting: The First Step to Financial Control

Making a budget is key to taking back control of your money. It helps you see where you can cut back on spending. This way, you can put more money towards paying off debts and reach financial stability.

A budget outlines your income and expenses over a set time, like a month or year. It should fit your income and lifestyle. Your income might come from jobs, family, or financial aid. Start by guessing you'll earn less and spend more to make a safe plan.

It's important to track all your expenses, fixed and variable. This helps you understand where your money goes. You can then make changes to spend less. A good budget also sets clear financial goals to help you get out of debt.

Tools like spreadsheets, websites, and apps can help with budgeting. They give you a clear plan to manage your money. It's also key to regularly review and update your budget as your life changes.

"Budgeting is the key to financial freedom. It empowers you to take control of your money, rather than letting it control you." - Jane Doe, Financial Advisor

Budgeting isn't just about spending less. It's about making money choices that match your long-term goals. By doing this, you start to break free from debt and reach financial stability.

Dealing with Debt Collectors and Time-Barred Debts

Dealing with debt collectors can be tough, but knowing your rights is crucial. The debt collection industry in the U.S. is a $13.7 billion business. It's important to protect yourself from unfair practices.

Debt collectors must give you information about the debt. They can't harass or lie to you. Also, there's a time limit, called the statute of limitations, after which they can't sue you. This time is usually 3 to 6 years, depending on the debt and where you live.

Even if debts are old, they can stay on your credit report for up to 7 years. This can hurt your chances of getting loans or credit cards in the future. But, paying on an old debt can make the collector have more time to sue you. Writing to the collector or making changes to the debt can also reset the clock.

| Debt Type | Statute of Limitations |

|---|---|

| Credit Card | 3-6 years |

| Medical | 3-6 years |

| Student Loans | 3-10 years |

| Mortgage | 3-6 years |

You have rights under the Fair Debt Collection Practices Act (FDCPA). You can ask for debt validation and written details from collectors. Disputing an old debt without admitting to it might not reset the clock. So, it's key to know your options with time-barred debts.

"Unpaid debts can negatively affect credit scores for up to seven years, leading to higher interest rates on loans and difficulties in getting credit."

Being proactive and informed helps you deal with debt collectors and protect your rights. Remember, knowing your stuff is key to managing your finances well.

Credit Counseling: A Trusted Ally

Struggling with debt can feel overwhelming. Credit counseling offers a helping hand. These non-profit groups provide personalized advice and solutions. They help you create a debt plan, manage your budget, and learn about finances.

Finding a Legitimate Credit Counselor

Not all credit counseling is the same. It's important to find a reputable, certified service. Look for these qualities:

- Non-profit status: Good services are non-profit, focusing on helping you, not making money.

- Certified counselors: Choose agencies with trained counselors for detailed guidance.

- Transparent fees: Honest services will tell you about fees upfront, without surprises.

- Positive reviews: Check what others say to see if the service is effective and well-liked.

Finding a trusted credit counselor can help you manage debt and take control of your finances.

| Key Statistics | Findings |

|---|---|

| Response rate of the survey | 64% |

| Number of surveys received | 210 |

| Demographic distribution of respondents | 72% female, 79% white, 53% married, 69% working full-time, 36% with a college degree, 33% with a family income of $30,000-$49,999 |

| Completion behavior rate of the debt management plan (DMP) among respondents | 64% |

| Intention to stay in DMP to reduce debt | Average score of 6.4 |

| Attitude towards being in DMP | Average score of 6.3 |

| Subjective norm scores for family and friends' opinion | 5.0 and 4.6 respectively |

| Perceived behavioral control difficulty rating and satisfaction with DMP's service | 5.0 and 6.3 respectively |

Working with a reputable credit counseling service can help you tackle debt. They offer personalized advice and support. This path leads to financial freedom and stability.

Debt Relief Options: Pros and Cons

Dealing with debt can be tough, but knowing the good and bad of each option helps. You might look at debt consolidation loans, credit counseling, or even bankruptcy. Each has its own benefits and downsides to think about.

Debt Consolidation Loans

Debt consolidation loans can make paying off debts easier with lower interest rates and one monthly payment. But, you need good credit to get the best rates. They might also have fees or penalties for late payments.

Debt Settlement

Debt settlement companies charge 15% to 25% of the debt they settle. This can be expensive. It might lower your debt but hurt your credit score a lot.

Bankruptcy

Bankruptcy can wipe out or reorganize some debts, giving you a fresh start. But, it can also hurt your credit for up to 10 years. Think carefully before choosing bankruptcy.

Credit Counseling

Credit counseling services can help lower interest rates and forgive penalties. They usually cost less than debt relief companies. But, they might not work for everyone, especially those with a lot of debt.

Choosing the right debt relief strategy depends on your financial situation and goals. Talking to financial experts can help you make the best choice for becoming debt-free.

| Debt Relief Option | Potential Benefits | Potential Drawbacks |

|---|---|---|

| Debt Consolidation Loans | Lower fixed interest rates Fixed monthly payment plan | Require good or excellent credit May include administrative fees and penalties |

| Debt Settlement | Potential reduction in overall debt | Fees can be 15% to 25% of settled debt Significant negative impact on credit score |

| Bankruptcy | Discharge or restructure certain debts Provide a fresh start | Negative impact on credit score for up to 10 years Long-term consequences |

| Credit Counseling | Negotiate with creditors to reduce interest rates Secure penalty forgiveness | May not be suitable for large amounts of debt Require ability to make minimum payments |

There's no single solution for debt relief. Your financial situation is unique, and finding the right path to debt freedom takes careful thought. By understanding the pros and cons of each option, you can make a choice that fits your financial goals and moves you towards financial freedom.

The Consumer Credit Trap: Avoiding Scams

Dealing with consumer credit can be tricky. Debt relief scams and predatory lending are everywhere. People looking for financial help need to watch out for financial fraud and consumer protection issues.

Scammers prey on those in financial trouble. They promise quick fixes or easy money with no checks. The "Financial Hardship Department" scam is one example, using phishing and asking for personal info. People are often rushed into bad loans or scams.

It's key to research any debt relief service or lender before committing. Watch out for companies asking for upfront payments or making big promises. Real companies are clear about their services and fees. They might even suggest working with a credit counselor to help with debt.

Protecting yourself from scams is crucial to break free from debt. Stay informed, check if services are legit, and seek advice from trusted sources. This way, you can move through the consumer credit world safely and avoid scams.

| Scam Type | Description | Warning Signs |

|---|---|---|

| Mortgage Flipping | Repeatedly encouraging refinancing within a short period to charge high points and fees | Pressure to refinance frequently |

| Equity-Skimming Foreclosure "Rescue" Scam | Exploiting financial distress to charge fees for supposed services | Unsolicited offers, requests for upfront fees |

| Home Improvement Loan Scams | Contractors requiring upfront money and not completing work, or charging significantly more than the original estimate | Unrealistic estimates, demands for upfront payments |

By being careful and seeking advice, you can avoid scams in the debt relief world. This helps those in financial trouble stay safe.

Mortgage and Auto Loan Troubles

Mortgage and auto loans can cause a lot of stress. Issues like mortgage default, foreclosure, repossession, and auto loan delinquency can affect your finances and mood. These problems can be very serious.

One key step is to talk openly with your lenders. If you're having trouble with payments, contact your lender right away. They might offer help like modified plans or temporary breaks.

Escaping the Consumer Credit Trap: Smart Money Moves: Guide. But watch out for scams that promise to help with mortgage troubles. These scams can make things worse. Look for real help from trusted housing counseling services. They can guide you through tough times.

To avoid mortgage default, foreclosure, repossession, and auto loan delinquency, keep a close eye on your money. Check your budget, pay debts first, and save for emergencies. These steps can help you stay financially stable.

| Mortgage Troubles | Auto Loan Troubles |

|---|---|

| Mortgage default Foreclosure Predatory lending practices Accessing housing counseling services | Auto loan delinquency Repossession Subprime auto loans with high interest rates Unequal treatment based on race and credit score |

By facing these problems head-on and getting the right help, you can manage mortgage and auto loan issues. This way, you can move towards a more stable financial future.

"The key to avoiding mortgage and auto loan troubles is to maintain open communication with your lenders and be proactive in managing your finances." - Financial Advisor, Jane Doe

Student Loan Debt: Unique Challenges

Escaping the Consumer Credit Trap: Smart Money Moves: Guide. Student loan debt is a big problem for millions in the U.S. It's different from other debts because it needs a special way to handle. This part talks about the special issues with student loans and how to deal with them.

Federal Loan Programs and Repayment Options

Those with federal loans might get help from the Department of Education. They can try income-driven plans or Public Service Loan Forgiveness. These options can make payments easier or even wipe out the debt for certain jobs.

Private Student Loans: Limited Relief

Private loans, however, offer less help. They often have strict payment plans and few forgiveness options. This makes it hard to manage private loans.

About 44 million people in the U.S. owe student loans, with a total debt of over $1.3 trillion. Those with a bachelor's degree owe around $30,000 on average.

Seeking Assistance and Avoiding Scams

Escaping the Consumer Credit Trap: Smart Money Moves: Guide. If you owe student loans, look into your options and talk to your servicer. Be careful of companies that promise help for a fee. Real credit counseling agencies can offer real help with your student loan problems.

"Student loan debt has become a significant financial burden for millions of Americans. Unlike other consumer debts, student loans present unique challenges that require a tailored approach to manage and alleviate the burden."

| Metric | Value |

|---|---|

| Total Student Loan Debt in the U.S. | Over $1.3 trillion |

| Number of Individuals with Student Loan Debt | Approximately 44 million |

| Average Debt Load for Bachelor's Degree Graduate | Around $30,000 |

| Student Loan Default Rate | 11.2% |

The U.S. student loan crisis affects many. It's a big problem for individuals, families, and the economy. We need to tackle it with new policies, education, and support for borrowers.

Strategies to Break the Debt Cycle

To get out of the debt cycle, you need a plan that includes awareness, discipline, and smart money moves. The first step is to face the problem and understand how much debt you have. If you're late on payments or can't pay off your credit cards, it's time to act. Escaping the Consumer Credit Trap: Smart Money Moves: Guide

Awareness and Acknowledgment

Spotting signs of financial trouble is key. This includes making only the minimum payment on your credit card for two months. Not saving money can also lead to big financial problems. By talking openly about your financial issues, you can start to fix them.

Budgeting and Financial Planning

Creating a detailed budget and financial plan is vital next. A budget helps you see where you can cut spending and pay off debt. Paying off debts with high interest rates first saves you money in the long run. Also, managing your credit well can help improve your score and break the debt cycle. Escaping the Consumer Credit Trap: Smart Money Moves: Guide

My Blogs

Health: https://bodmelt.com

Mobile Tech https://earnessential.com

Security https://bellpeek.com

Kids https://totpeek.com