Your business success depends on understanding the right numbers. Many organizations struggle because they confuse different types of performance indicators. Knowing which metrics matter most can transform how you make decisions. Financial management involves two distinct functions that serve different purposes. One area focuses on historical accuracy and compliance. The other drives strategic planning and future growth. This distinction is crucial for sustainable success. The difference between these measurement categories impacts every level of your organization. From daily operations to boardroom strategy sessions, having the right data matters. Tracking both sets of indicators provides a complete picture of your company's health.

This comprehensive approach prevents the common mistake of focusing on one area while neglecting the other. By understanding these metrics, you gain the insight needed for both operational stability and long-term value creation.

Key Takeaways

- Financial and accounting metrics serve fundamentally different business purposes

- One function looks backward for accuracy, while the other plans forward for growth

- Understanding this distinction is essential for informed decision-making

- Both measurement types impact operations and strategic planning

- Tracking both categories prevents common organizational blind spots

- The right metrics provide a complete picture of company performance

- This knowledge supports both daily stability and long-term success

Introduction: Defining the Roles of Finance and Accounting KPIs

The effectiveness of your organization relies on recognizing the distinct functions within your financial ecosystem. While both areas work with your company financial data, they approach this information from completely different angles that serve different purposes. Think of your accounting function as a mirror reflecting what has already occurred. This operational backbone ensures every financial transaction gets recorded accurately according to GAAP standards. Your team processes accounts payable and receivable, runs payroll, and reconciles accounts throughout the month.

The Strategic Vision of Finance

Your financial planning team acts as a compass pointing toward future opportunities. They analyze data through growth and strategy lenses, identifying trends and potential concerns. This forward-looking perspective helps senior executives make informed decisions about investments and initiatives.

The Operational Backbone of Accounting

Your accounting operations maintain the discipline required for compliance and control. The team tracks balance sheet items, manages banking relationships, and ensures proper documentation over time. Month-end closing brings all transactions together for accurate reporting.

Knowing the difference between these functions helps you allocate resources effectively. One focuses on historical accuracy while the other drives future value creation. Both are essential for complete financial health.

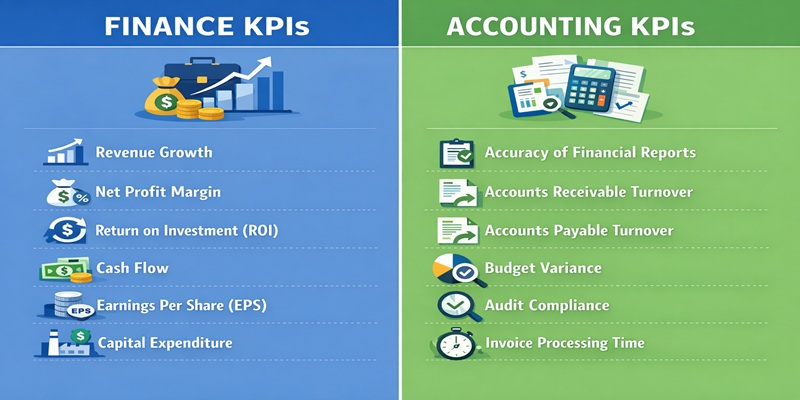

Key Finance KPIs Driving Strategic Growth

Growth-oriented organizations leverage specific indicators to measure their strategic financial health. These metrics help leadership teams assess performance and drive sustainable expansion.

Measuring Profitability with Gross Profit Margin and ROI

Gross Profit Margin reveals how efficiently your business produces goods or services. A higher margin indicates strong pricing and cost management.

Return on Investment shows how effectively you deploy capital across initiatives. It answers whether you're getting maximum value from your investments.

Economic Value Added goes beyond simple profits. It measures real value generation for shareholders after covering capital costs.

Managing Liquidity with Current Ratio and Cash Flow Forecast

The Current Ratio compares assets to liabilities, indicating short-term financial health. It shows if your business can meet immediate obligations.

Cash Flow Forecast predicts upcoming inflows and outflows. This forward-looking metric helps maintain liquidity and prevent bottlenecks.

Free Cash Flow represents discretionary funds after expenses. You can use this for dividends, debt reduction, or strategic growth initiatives.

Return on Invested Capital measures how effectively you convert capital into profits. It must exceed your cost of capital to create genuine value.

Critical Accounting KPIs for Compliance and Efficiency

Your company's ability to meet regulatory standards while optimizing processes hinges on carefully selected performance measurements. These operational metrics serve as vital signs for your financial health, ensuring smooth business operations and legal adherence.

Optimizing Cash Collections with Days Sales Outstanding

Days Sales Outstanding (DSO) tracks how quickly you receive payments after sales. A lower DSO means faster cash inflows and stronger working capital management.

Monitoring this metric helps identify credit issues and collection inefficiencies. Shortening your sales outstanding period reduces reliance on external financing and improves liquidity.

Ensuring Accuracy through Invoice Accuracy Rate and Budget Variance

Invoice Accuracy Rate measures error-free invoices your team issues. Fewer mistakes accelerate payment cycles and strengthen vendor relationships. Budget Variance compares actual results against planned figures. This serves as an early warning system for financial inefficiencies or operational problems. Close Cycle Time measures how quickly your team closes monthly books. Shorter cycles enhance reporting accuracy and free resources for analysis.

Finance vs Accounting KPI: Clear Distinctions and Overlapping Insights

Navigating your organization's performance requires understanding two distinct measurement systems. These metrics serve different purposes while providing complementary insights for your business decisions.

Comparative Analysis of Key Metrics

The table below highlights critical differences between these measurement categories. Understanding these distinctions helps you apply the right metrics for specific management needs.

| Dimension | Strategic Growth Indicators | Operational Compliance Indicators |

| Primary Focus | Long-term strategy and growth | Accuracy and regulatory compliance |

| Example Metrics | ROI, EVA, Cash Flow Forecast | DSO, Invoice Accuracy, Budget Variance |

| Primary Users | Executives, Investors, Board Members | Accountants, Controllers, Auditors |

| Time Orientation | Forward-looking and predictive | Historical and real-time |

Operational indicators alone don't measure value creation. Your company might show excellent margins but still destroy shareholder value if return on invested capital falls below your cost of capital.

User Perspectives: Strategic Leaders vs. Operational Managers

Strategic growth metrics primarily serve executives and investors. These leaders make decisions about capital allocation and long-term direction. Operational compliance indicators serve accountants and controllers. These professionals focus on transaction accuracy and regulatory standards. The most successful businesses use both measurement systems strategically. Operational metrics keep your engine running smoothly while strategic indicators steer your company toward growth.

Leveraging Both KPI Sets for Business Growth

True organizational insight emerges when you combine historical accuracy with forward-looking projections. Focusing exclusively on one area creates dangerous blind spots in your management approach.

Building an Integrated Reporting Structure

Create monthly dashboards that display operational and strategic indicators side by side. This gives you a complete view of your company's health. Review trends across multiple periods rather than single data points. Directional patterns reveal more than isolated snapshots. Your reporting processes should serve different audiences within your organization. Operational managers need detailed team performance metrics. Executives require high-level indicators for capital allocation decisions.

"When operational metrics remain stable but strategic indicators deteriorate, your current operations are sound but your direction needs reassessment".

Aligning Metrics with Business Decisions

Connect specific measurements directly to management choices. Cash flow forecasts should inform your expansion timing and financing needs.

Use these indicators as an early warning system for strategic initiatives. This alignment ensures data drives decisions rather than just documenting past performance.

As your organization grows, ensure your team has the resources and skillset to support this integrated approach. A comprehensive comparison of these measurement categories helps optimize your reporting structure for sustainable company growth.

Conclusion

Building a resilient organization requires balancing operational precision with strategic foresight through appropriate performance indicators. Your leadership effectiveness increases when you understand which metrics reflect past performance versus those predicting future opportunities. The integration of compliance-focused measurements with growth-oriented indicators creates a complete picture of your company's trajectory. This holistic approach transforms financial reporting from a compliance tool into a powerful decision-making engine. Your accounting team provides the foundation with accurate operational data. This supports cash management, accounts payable efficiency, and compliance adherence. Meanwhile, strategic indicators guide capital allocation and long-term growth. As highlighted in this comprehensive analysis, mastering both perspectives positions your business for sustainable success. You achieve operational stability while pursuing strategic investments with confidence. The right metrics balance ensures informed decisions at every organizational level. This approach maintains financial health through economic cycles while driving meaningful growth.