A cash flow statement reveals the true financial health of a company by tracking actual money movements, unlike accounting profits that can be manipulated through non-cash adjustments. Hedge fund analysts rely heavily on cash flow analysis because it provides unfiltered insights into how well a business generates and manages cash across its operations, investments, and financing activities.

?feature=shared">?feature=shared

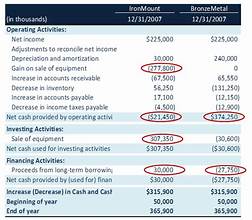

Professional analysts focus on three critical sections of the cash flow statement - operating activities that show core business performance, investing activities that reveal growth strategies, and financing activities that indicate capital structure decisions. Each section tells a different story about the company's financial position and future prospects.

Learning to analyze cash flows like a professional requires understanding key metrics, identifying red flags, and recognizing patterns that separate strong companies from weak ones. The ability to read a cash flow statement enables smarter business decisions by revealing whether a company actually generates the cash it claims to produce on paper.

Key Takeaways

- Cash flow statements show real money movements and provide more reliable insights than accounting profits alone

- The three main sections reveal different aspects of financial health through operating performance, investment decisions, and financing choices

- Professional analysis requires calculating specific metrics and identifying patterns that indicate long-term business strength

Core Principles of Cash Flow Statement Analysis

Cash flow statement analysis provides a real-world view of how money moves through a company, unlike accounting profits that can be adjusted. The three main sections reveal different aspects of financial health that income statements and balance sheets cannot show alone.

Role of Cash Flow Statements in Investing

Cash flow statements show the actual movement of money in and out of a business, making them critical for investment decisions. Unlike profits shown on income statements, cash flows cannot be easily manipulated through accounting adjustments.

Investors use cash flow data to determine if a company can pay its bills, fund growth, and return money to shareholders. Operating cash flow tells investors whether the core business generates real cash. Free cash flow shows how much money remains after necessary investments.

Professional analysts focus on cash flow quality to evaluate earnings quality. A company reporting high profits but low cash flow may have accounting issues. Strong cash generation indicates a healthy business model that can sustain operations and growth.

Cash flow analysis helps investors spot red flags before they appear in other financial statements. Companies can show profits while burning cash, which eventually leads to financial trouble.

Key Differences with Income Statement and Balance Sheet

The income statement records revenues and expenses when they occur, not when cash changes hands. The cash flow statement tracks only actual cash movements. This timing difference creates important gaps that analysts must understand.

Income statements include non-cash items like depreciation and stock-based compensation. Cash flow statements add these back to show real cash generation. Revenue recognition rules allow companies to record sales before receiving payment, but cash flow statements reveal the true timing.

Balance sheets show financial position at a single point in time. Cash flow statements show how that position changed over a period. Working capital changes on the balance sheet appear as cash flow impacts in the operating section.

The three statements work together to provide a complete financial picture. Income statements show profitability, balance sheets show financial position, and cash flow statements show liquidity and cash generation ability.

Overview of the Three Primary Sections

Cash flow statements divide into three main sections that reveal different aspects of business operations. Each section shows how management allocates and generates cash resources.

Operating Activities include cash from core business operations. This section starts with net income and adjusts for non-cash items and working capital changes. Strong operating cash flow indicates a profitable business model that generates real cash.

Investing Activities show cash spent on or received from long-term assets. Capital expenditures for equipment and facilities appear here. Asset sales and acquisitions also impact this section. Negative investing cash flow often indicates growth investments.

Financing Activities track cash flows between the company and its investors. Debt payments, stock buybacks, and dividend payments reduce cash. New borrowing and stock sales increase cash. This section shows how companies fund operations and return money to shareholders.

Breaking Down Cash Flow from Operating Activities

Operating activities reveal how much cash a company generates from its core business operations, starting with net income and adjusting for non-cash items and working capital changes. These adjustments transform accrual-based earnings into actual cash flows that fund operations and growth.

Net Income Reconciliation

The cash flow from operating activities begins with net income as the foundation. This starting point represents the company's reported profits under accrual accounting rules.

However, net income includes many non-cash items that don't represent actual cash movement. Revenue might be recorded when earned, not when cash is collected. Expenses are recorded when incurred, not when paid.

Key reconciliation items include:

- Revenue recognized but not yet collected

- Expenses recorded but not yet paid

- Non-cash charges like depreciation

- One-time gains or losses

Analysts examine how net income compares to operating cash flow over time. A company consistently generating higher operating cash flow than net income typically indicates strong cash collection and conservative accounting practices.

Non-Cash Adjustments: Depreciation, Amortization, Stock-Based Compensation

Companies add back non-cash expenses to net income because these items reduced reported profits without affecting cash. Depreciation represents the largest adjustment for most businesses.

Depreciation and amortization spread the cost of long-term assets over their useful lives. While these expenses appear on the income statement, no cash actually leaves the company during the current period.

Stock-based compensation allows companies to pay employees with equity instead of cash. This expense reduces net income but preserves cash for operations.

The size of these adjustments reveals important business characteristics. Capital-intensive companies show larger depreciation add-backs. Tech companies often have substantial stock-based compensation expenses.

Analysts compare these adjustments across periods and competitors to identify trends in capital intensity and compensation strategies.

Assessing Working Capital Changes

Working capital changes show how efficiently a company manages its short-term assets and liabilities. These movements directly impact cash flow and reveal operational effectiveness.

Accounts receivable increases reduce cash flow when customers take longer to pay. Growing receivables might indicate collection problems or looser credit terms.

Inventory changes affect cash differently by industry. Manufacturing companies need inventory to support sales, but excess inventory ties up cash unnecessarily.

Accounts payable increases boost cash flow by extending payment periods to suppliers. However, stretching payables too far can damage supplier relationships.

Analysts calculate working capital as a percentage of sales to spot trends. Seasonal businesses show predictable working capital patterns, while deteriorating ratios might signal operational issues.

The relationship between sales growth and working capital changes indicates how much cash the company needs to fund expansion.

Examining Cash Flow from Investing Activities

Capital expenditures reveal how much a company invests in future growth, while asset sales show how management converts investments back to cash. These activities directly impact a company's long-term competitive position and cash generation ability.

Capital Expenditures and Acquisitions

Cash flow from investing activities shows the cash spent on long-term investments. Capital expenditures represent the largest component for most companies.

Capital expenditures include spending on property, plant, and equipment. Analysts compare CapEx to depreciation to gauge investment intensity. When CapEx exceeds depreciation, the company grows its asset base.

Growth companies typically show higher CapEx ratios. Mature companies often maintain CapEx near depreciation levels. This pattern indicates whether management focuses on expansion or maintenance.

Acquisitions appear as large cash outflows in the investing section. These purchases can transform a company's operations quickly. Analysts examine acquisition frequency and success rates over time.

The timing of acquisitions matters significantly. Companies making acquisitions during market peaks often overpay. Those acquiring assets during downturns typically generate better returns.

Asset Sales and Their Impacts

Asset sales generate cash inflows in the investing activities section. These transactions can signal strategic shifts or financial distress.

Strategic asset sales occur when companies exit non-core businesses. Management sells these assets to focus resources on profitable segments. The cash proceeds often fund core business expansion.

Distressed asset sales happen when companies need immediate cash. These sales typically occur at below-market prices. Multiple asset sales within short periods raise red flags about financial health.

?feature=shared">?feature=shared

Analysts track the frequency and pricing of asset sales. Occasional sales at fair values indicate good capital allocation. Frequent sales at discounted prices suggest operational problems.

The use of sale proceeds reveals management priorities. Reinvestment in core operations shows growth focus. Debt reduction indicates conservative financial management.

Analyzing Cash Flow from Financing Activities

Cash flow from financing activities reveals how companies manage their capital structure and return money to investors. Debt management patterns show financial strategy while dividend policies indicate management's confidence in future earnings.

Debt Issuance and Repayment

Hedge fund analysts examine debt patterns to understand a company's financial flexibility and management priorities. Rising debt issuance often signals expansion plans or refinancing needs.

Key debt metrics to track:

- Net debt issuance vs. repayment trends

- Timing of major debt transactions

- Debt-to-equity ratio changes over time

Companies issuing new debt show positive financing activities cash flow. This indicates capital raising for growth or operations.

Consistent debt repayment demonstrates strong cash generation. It also shows management's commitment to reducing leverage.

Red flags include:

- Frequent emergency debt issuance

- Inability to refinance maturing debt

- Rising interest payments relative to cash flow

Analysts compare debt activity timing with business cycles. Smart companies issue debt when rates are low and repay during strong earnings periods.

Dividends and Shareholder Returns

Dividend payments appear as negative cash flow in the financing section. Consistent dividend growth signals management confidence in sustainable earnings.

Analysts track dividend coverage ratios and payout consistency. Companies maintaining dividends during tough periods show financial strength.

Share repurchase analysis includes:

- Buyback timing relative to stock price

- Total shares outstanding reduction

- Impact on earnings per share

Shareholders benefit from both dividends and buybacks. However, timing matters significantly for returns.

Suspended or reduced dividends often indicate financial stress. Management typically cuts dividends only when necessary to preserve cash.

Warning signs:

- Borrowing money to pay dividends

- Inconsistent dividend policies

- Share dilution through excessive issuance

Hedge fund analysts prefer companies with predictable shareholder return policies. This consistency indicates disciplined capital allocation and reliable management decision-making.

Interpreting the Cash Flow Statement Like a Hedge Fund Analyst

Hedge fund analysts focus on cash flow quality, sustainability patterns, and warning signals that reveal a company's true financial position. They compare operating cash flows with free cash flow metrics to assess long-term viability and investment potential.

Identifying Quality and Sustainability of Cash Flows

High-quality cash flows come from core business operations rather than one-time events or accounting adjustments. Analysts examine the operating activities section to identify sustainable patterns.

Quality indicators include:

- Consistent cash flow from operations growth

- Cash flows that match or exceed net income

- Low dependence on working capital changes

- Minimal non-cash adjustments

Sustainable cash inflows demonstrate predictable business performance. Analysts look for companies where operating cash flows grow steadily over multiple quarters without large fluctuations.

Working capital changes reveal important trends. Companies that constantly need more inventory or extend customer payment terms may face operational challenges.

Strong liquidity positions allow companies to invest in growth opportunities. Analysts prefer businesses that generate cash consistently rather than rely on external financing.

The relationship between net income and cash flow from operations shows earnings quality. Large gaps between these numbers often indicate accounting manipulation or unsustainable business practices.

Red Flags and Warning Signals

Several warning signals indicate potential problems with a company's financial health. Experienced analysts watch for these patterns when reviewing cash flow statements.

Major red flags include:

- Declining cash flow from operations despite growing revenues

- Heavy reliance on financing activities for cash generation

- Consistently negative free cash flow

- Large increases in accounts receivable relative to sales

Companies that show strong profits but weak operating cash flows often face collection problems or use aggressive accounting methods. This disconnect signals potential trouble ahead.

Negative free cash flow for extended periods indicates the company cannot fund operations and growth from business activities. This pattern forces reliance on debt or equity financing.

Rapid inventory buildups without corresponding sales growth suggest demand problems. Analysts view this as an early warning of future revenue declines.

Companies that constantly issue debt or sell assets to maintain operations face serious sustainability issues. These financing activities cannot continue indefinitely without harming long-term prospects.

Comparative Analysis with Free Cash Flow

Free cash flow provides the clearest picture of a company's ability to generate excess cash after necessary investments. Analysts calculate this by subtracting capital expenditures from cash flow from operations.

The free cash flow calculation reveals true earnings power: Free Cash Flow = Operating Cash Flow - Capital Expenditures

Companies with strong free cash flow can pay dividends, reduce debt, or invest in growth opportunities. This flexibility indicates superior financial health compared to cash-constrained competitors.

Analysts compare free cash flow margins across similar companies to identify the most efficient operators. Higher margins typically indicate competitive advantages or better management execution.

Free cash flow yield helps determine if a stock trades at reasonable valuations. This metric divides free cash flow per share by the current stock price.

Consistent free cash flow generation over multiple years demonstrates business model strength. Analysts prefer companies that maintain positive free cash flow even during economic downturns or industry challenges.

The relationship between operating cash flows and free cash flow shows how much capital the business requires for maintenance and growth.