As I sit here, I feel a mix of excitement and worry. I want a secure future but feel lost in personal finance. Assets, liabilities, net worth, and accounting equations confuse me. Personal Finance Assets vs Liabilities: Know the Difference can hep put it into perspective.

But knowledge is power. I'm ready to learn about personal finance. Let's explore the key differences between assets and liabilities. Understanding these can lead to a brighter financial future.

Key Takeaways

- Knowing the difference between assets and liabilities is key to wealth and stability.

- Assets bring value or income, while liabilities are debts to be paid.

- Managing assets and liabilities well can boost your net worth and cash flow.

- The accounting equation (Assets = Liabilities + Equity) is vital for financial decisions.

- Being financially literate helps make smart choices about your money.

Understanding Assets and Liabilities

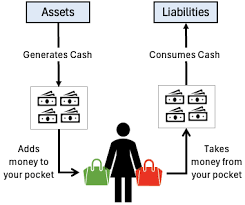

Knowing the difference between assets and liabilities is key in personal finance. Assets are things that put money in your pocket and of value that you own. They can make money and offer long-term benefits. Examples include cash, investments, property and anything that helps you create value and puts money in your pocket, it could be your laptop as a blogger, the softwires that your use to create content for your audience etc.

Liabilities are debts or things you owe to others, simply put anything that take money out of your pocket to give to others is a liability, you hire purchase car, your home mortgage, your credit cards. This includes loans and mortgages. Both are listed on your personal finance balance sheet.

What are Assets?

Assets fall into two groups: current ( rents, cash) and non-current (Investments). Current assets are used up or turned into cash in a year.

Non-current assets last more than a year. This includes properties, investments and vehicles. Financial assets are investments in other companies. Intangible assets have value but are not physical, like brand name, trade marks, patents and intellectual properties ( this is another big money maker).

What are Liabilities?

Liabilities also have two types: current and non-current (mortgage, car loans, loans). Current liabilities are debts due in a year (Credit cards, consumer credits). Long-term liabilities are debts due later. This includes mortgages and loans. Knowing about both is important for a personal finance health.

The balance between assets and liabilities shows a company's health. The formula Assets - Liabilities = Equity shows a company's worth. Positive equity means the you're financially sound. Managing assets and liabilities well is crucial for your personal finance journey to become financially independent.

Understanding the difference between Assets and Liabilities

Knowing the difference between assets and liabilities is key in personal finance. Assets are things you own or are owed that puts money in your pocket. Liabilities are things you owe to others that take money out of your pocket. This knowledge helps figure out your financial health and net worth.

Assets help grow your wealth by making money or increasing in value. Examples include cash, investments, real estate, and valuable collectibles items. Liabilities, like loans, credit card balances, and mortgages, decrease your wealth by creating debt.

The accounting equation shows how assets and liabilities relate: Assets = Liabilities + Equity. This equation helps calculate your net worth. A positive net worth means you're financially healthy. A negative net worth shows you're in debt.

| Assets | Liabilities |

|---|---|

| Cash Investments (stocks, bonds, mutual funds)Real estate Vehicles Valuable possessions Accounts receivable | Loans (personal, auto, student)Credit card balances Mortgage payments Unpaid bills Taxes owed Accounts payable |

Grasping the asset-liability difference is vital for managing your finances well. By focusing on assets and reducing liabilities, you can boost your net worth and move toward financial independence. This leads to financial stability and security.

"The less you owe, the more you can save and invest to build your wealth." - Dave Ramsey

Current vs. Non-Current Assets and Liabilities

In finance, knowing the difference between current and non-current assets and liabilities is key. These categories help us see how well a you're doing financially. They show if you can handle your short-term and long-term debts.

The Accounting Equation

The accounting equation is key. It says a your personal finance assets must match your liabilities and equity. This is the base for seeing how your personal finance journal assets, liabilities, and equity are connected. It's vital for making financial decisions.

The formula is Assets = Liabilities + Owner's Equity. This makes sure a company's financial state is clear. The total value of its assets must equal its liabilities and shareholders' equity.

Assets include things like cash, accounts receivable, and property. Liabilities are debts like loans and bills.

Building Wealth and Financial Health

Building wealth and keeping your finances healthy are key for long-term success. To do this, focus on growing your assets and cutting down on liabilities. You can do this by saving, investing, paying off debt, and finding new ways to make money.

Increasing Assets

Investing in assets is a big step towards wealth. Assets can be stocks, bonds, real estate, or even starting a business. These can grow in value over time, boosting your net worth. Also, spreading out your investments can lower risks and make your finances more stable.

- Invest in dividend-paying stocks to earn passive income and grow your assets.

- Think about buying real estate, as property values often go up by 5-7% each year.

- Look into alternative investments like art or collectibles, which can be valuable even if they're not easy to sell.

Managing your cash flow well is also crucial. This means saving a part of your income for investments, not just using debt. Building a strong asset base makes you more financially stable and sets you on the path to wealth.

"Investing in dividend-paying stocks can lead to a significant increase in asset portfolio value over a five-year period, according to a recent study."

Asset vs. Liability Examples

Understanding assets and liabilities is crucial for good personal finance. Assets are things that make money or have value. Liabilities are debts that need to be paid. Let's look at some examples to make this clear.

Asset Examples:

- Cash and savings accounts

- Investments like stocks, bonds, and mutual funds

- Real estate, including your home or rental properties

- Valuable items like art, collectibles, or antiques

- Vehicles you own without a loan

Liability Examples:

- Mortgages on your home or investment properties

- Car loans for the vehicles you drive

- Credit card balances you haven't paid off

- Student loans for your education

- Personal loans or lines of credit

Looking at these examples can help you see how to turn liabilities into assets. By focusing on growing your assets and managing your liabilities well, you can improve your personal finance and wealth over time.

| Asset Examples | Liability Examples |

|---|---|

| Cash, investments, real estate, valuable possessions | Mortgages, car loans, credit card balances, student loans |

| Generate value or income | Obligations or debts that need to be paid off |

| Contribute to personal wealth and financial health | Can hinder financial investment and growth |

"The key to building wealth is to convert your liabilities into assets." - Robert Kiyosaki

Knowing the difference between assets and liabilities helps you make better personal finance choices. This way, you can work towards a more stable financial future.

Financial Literacy and Decision-Making

Personal Finance Assets vs Liabilities: Know the Difference. Learning about money is key to making smart choices. Knowing how to manage money helps you budget and invest wisely. This knowledge lets you control your financial future and reach your goals.

People start learning about money in their teens and early twenties. This is when they start working, managing their money, and taking out loans for school. Kids learn basic math skills from ages 3 to 5. Then, from 6 to 12, they start to understand simple money concepts.

As they grow older, from 13 to 21, they learn more about investing and handling debt. Teaching financial literacy involves different methods. These include learning by doing, direct teaching, and using real-life examples.

Learning through activities like financial coaching and simulations is very helpful. Schools are important in teaching these skills. They help students practice and learn from their financial decisions.

By focusing on personal finance education, you can make better money choices. This leads to better budgeting, investing, and debt management. It helps you make smart financial decisions and secure your future. Personal Finance Assets vs Liabilities: Know the Difference

Conclusion

Understanding the difference between assets and liabilities is key in personal finance. It helps in building wealth and making smart financial choices. By managing assets and liabilities well, people can achieve their financial goals.

Financial health comes from balancing what you have (assets) and what you owe (liabilities). Looking at current ratios and net worth can show how well you're doing financially. This helps in finding the best ways to manage your money.

Personal Finance Assets vs Liabilities: Know the Difference. Improving your financial literacy is crucial. It involves managing working capital, controlling debt, and making smart investments. Knowing how to handle assets and liabilities helps you make better financial decisions. This knowledge is the first step towards a secure and prosperous future.

FAQ

What are the key differences between assets and liabilities?

Personal Finance Assets vs Liabilities: Know the Difference. Assets are things of value you own, like cash, investments, and property. Liabilities are debts you owe, such as loans and mortgages. Assets help grow your wealth, while liabilities decrease it.

How are assets and liabilities categorized?

Assets and liabilities can be short-term (current) or long-term (non-current). Current items last less than a year, like cash and inventory. Non-current items last longer, such as property and equipment.

What is the accounting equation and why is it important?

The accounting equation shows that a company's assets equal its liabilities and equity. This equation helps understand how assets, liabilities, and equity are related. It's key for financial analysis and decision-making.

How can I build wealth and improve my financial health?

To grow wealth and improve finances, focus on increasing assets and reducing liabilities. Save, invest, and cut debt to boost your net worth. This strategy helps achieve financial stability.

Why is developing financial literacy important?

Financial literacy is crucial for smart money management. It helps create budgets and make investment choices. Knowing personal finance empowers you to control your financial future and reach your goals.