You need a clear approach to debt so it serves your goals instead of limiting them. Not all debt is automatically “bad.” When used to fund long-term value — like a degree that boosts earnings or a home that builds equity — borrowing can move your life forward. Think of credit as a tool. It can help when it supports wealth-building or income growth. It can hurt when it becomes the default answer to shortfalls. This guide shows how to decide when borrowing makes sense, how to pick the right credit or loan, and how to manage repayment without shrinking your options. You will learn real-world steps for tracking balances, due dates, and total costs.

The core promise: you’ll leave with a repeatable process to use every time you face new credit — from a card to a larger loan — so your future stays flexible and less stressful.

Key Takeaways

- Debt can be a tool for long-term value when used intentionally.

- Know when credit supports income growth and when it risks your cash flow.

- Focus on practical tracking: balances, due dates, and total cost.

- Use a repeatable decision process before taking new credit.

- Disciplined action preserves choices and reduces stress.

Decide Whether Borrowing Supports Your Financial Goals

Only borrow when the money moves you closer to a measurable goal, not just to fill a short-term gap. Start by writing one sentence that states your purpose. That keeps choices simple and clear.

Know your “why” and how it fits your life

Run a quick purpose test: condense your reason to one sentence and name the goal. Examples: boost earning potential, secure reliable transport, or consolidate high-cost balances.

When debt is strategic versus risky

Strategic debt ties to long-term value or cost savings. Risky debt covers daily expenses without a plan to change your budget. Ask how the new monthly payment affects savings, essentials, and an emergency fund.

Credit card readiness: questions to ask

Before getting a card, confirm you track due dates, monitor balances, and can pay on time consistently. Remember that carrying a balance raises the true price of purchases.

- Delay or save for nonessential purchases.

- Borrow only what closes a specific gap.

- Compare options and consider smaller amounts.

Tip: Your credit score and pricing matter. Good habits reduce costs and expand options for a wiser borrower.

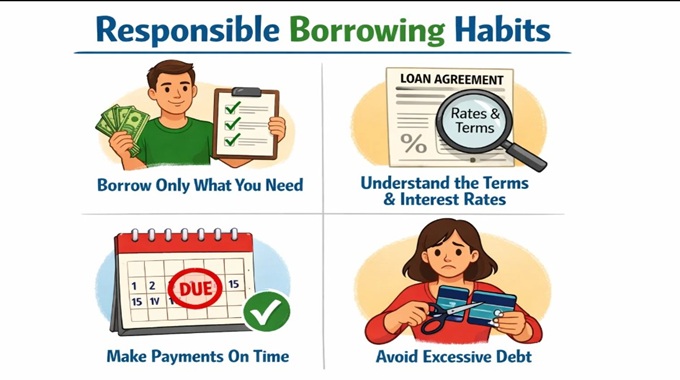

Responsible Borrowing Habits You Can Start Using Today

Before you sign, set a precise borrowing target that matches the expense you must cover. Only take the amount needed plus a small buffer so you avoid paying interest on unused money. This keeps total cost lower over the life of the loan.

Borrow only what you need, not the maximum you’re offered

Calculate the exact price, add a 5–10% buffer for unexpected costs, and lock that number as your target amount.

Shop loan and credit options with your credit score in mind

Compare APR, term length, and total repayment. Your credit profile affects the interest you’ll pay, so check offers from multiple lenders.

Understand the full cost of borrowing

Look beyond the monthly payment. Add interest, origination or late fees, and the total paid over time to see the real price of loans.

Learn key loan terms before you sign

Know fixed vs variable rates, prepayment penalties, and, when relevant, subsidized vs unsubsidized structures for student loans.

Get organized and avoid stacking debt

Keep one digital folder and one physical folder for agreements. Track balances, due dates, minimums, and contact info on a single sheet. Review total balances across credit so you don’t stack multiple payments that strain your budget.

Build repayment into your budget

Treat repayment like rent: include it as a required monthly expense and run a quick stress test to ensure payments don’t crowd out essentials or savings. For guidance, learn more about making smart choices.

Stay on Track With Payments, Interest, and Your Credit Score

Stay proactive with payments to avoid surprises that raise the total cost of debt. Timely payments stop late fees, protect your credit, and keep future loan options open.

Make payments on time to avoid fees and protect your credit score

Late payments can trigger fees and a negative mark on your report. That raises borrowing costs and limits lenders' offers later.

Automate payments and set reminders to prevent missed due dates

Use auto-pay for minimums and add calendar alerts to confirm funds. Set a small buffer in your account to avoid overdrafts from multiple withdrawals.

Pay interest as it accrues when possible to reduce long-term costs

On many student loans, interest starts accruing at disbursement; unpaid interest may capitalize and raise your principal after a grace period. Paying accrued interest prevents compounding and lowers total interest paid over time.

If you can’t make a payment, contact your lender early to discuss options

Call lenders before a missed due date to ask about hardship plans, revised due dates, forbearance, or short-term restructuring. Early contact often prevents damage to your score.

Use extra payments strategically to reduce principal and shorten the loan timeline

Confirm extra amounts apply to principal. Target higher-rate loans first to cut total interest and finish payments sooner.

"A small extra payment each month can shave years off a loan and save you thousands."

For tips on strengthening your record, see how simple steps can build your credit score. Use bank alerts, bill-pay tools, and lender portals as practical resources to track payments and spot issues quickly.

Conclusion

Use debt as a deliberate tool: the goal is not to avoid every loan, but to choose credit in a way that supports your goals and protects your future. Keep decisions simple and repeatable so they become routine. Ask three questions: why you need it, does the payment fit your budget, and what the total cost will be. Compare offers and pick the option that lowers long-term price, not just the monthly number. Carry forward the highest-impact actions: borrow only what you need, avoid stacking balances, and keep documents and due dates organized so nothing slips. Treat repayment as a fixed monthly expense so essentials and savings stay intact.

Next steps: list every loan and credit account in one place, set automation or reminders, and pick one change to reduce cost this week. Learn more about the path at responsible borrowing.