When I plan my monthly budget, I feel overwhelmed. There are so many financial needs and wants. But the 50/30/20 budget rule helps me stay on track. It's a simple way to manage my money and reach my goals.

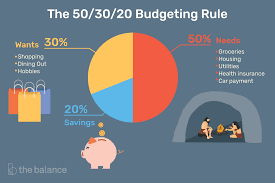

This rule divides your income into three parts: 50% for needs, 30% for wants, and 20% for savings. It's a clear way to handle your money. It helps you focus on what's important, enjoy some luxuries, and save for the future.

Key Takeaways

- The 50/30/20 budget rule provides a clear framework for allocating your after-tax income.

- It emphasizes the importance of balancing essential expenses, discretionary spending, and savings.

- Consistency and personalization are key to successfully implementing the 50/30/20 rule.

- Automating your savings can help ensure you reach your financial goals.

- The rule can be adjusted to fit your unique financial situation and priorities.

Understanding the Three Categories

The 50/30/20 budget rule helps you find a balance. It divides your money into three main areas: needs, wants, and savings. Let's look at each part and how they work together to manage your finances well.

What is the 50/30/20 Budget Rule?

The 50/30/20 budget rule is a simple way to manage your money. It suggests you spend 50% on needs, 30% on wants, and 20% on savings. This helps you balance your daily costs, fun spending, and saving for the future.

Key Takeaways

- The 50/30/20 budget rule divides your after-tax income into three distinct categories: needs, wants, and savings.

- Needs are essential expenses like rent, utilities, groceries, and minimum debt payments.

- Wants are discretionary expenses that enhance your lifestyle but are not necessary for survival, such as dining out, entertainment, and upgraded products.

- Savings include contributions to emergency funds, retirement accounts, and other long-term financial goals.

- The budget system aims to help individuals gain control over spending and achieve financial goals.

Understanding the Three Categories

The 50/30/20 budget rule helps you understand the difference between needs and wants. It guides you to make a financial plan. If you can't save 20% at first, start with a 60-30-10 split. This way, you can increase your savings over time.

By using the 50/30/20 rule, you work towards a secure financial future. You'll have enough savings or pay off debt. This method lets you focus on what's important while still enjoying life and saving for the future.

50%: Needs

The 50/30/20 budget rule says to spend 50% of your income on needs. These are things you must have to survive and be comfortable. Here are some examples:

- Rent or mortgage payments

- Car payments

- Groceries

- Insurance (health, auto, life)

- Minimum debt payments

- Utilities (electricity, water, internet, etc.)

Half of your income should go to these essential expenses. This rule helps you manage your personal finance and daily life.

For instance, if you make $5,000 a month, you should spend $2,500 on needs. This money covers rent, car payments, and other important bills.

"Focusing on needs first allows you to cover your essential expenses and build a solid financial foundation."

By setting aside 50% for needs, you meet your basic needs. This leaves 30% for wants and 20% for savings.

30%: Wants

The 50/30/20 budget rule says to spend 30% of your after-tax income on "wants". These are things that make life better but aren't essential. Examples include dining out, entertainment, and vacations.

Wants are important for a good life, even if they're not necessary. The 30% for wants lets you enjoy life without feeling guilty. It's a way to balance spending and saving.

Bankrate's Living Paycheck to Paycheck Survey found 36 percent of Americans live paycheck to paycheck. The 50/30/20 rule helps avoid overspending on wants. It keeps room for fun spending and a healthy balance between work and life.

Sticking to the 30% for wants means you can spend on things that make you happy. This doesn't risk your financial future or long-term goals. It's a smart way to budget and live a fulfilling life.

| Budget Category | Percentage | Example (based on $3,000 monthly income) |

|---|---|---|

| Needs | 50% | $1,500 |

| Wants | 30% | $900 |

| Savings/Debt Repayment | 20% | $600 |

Following the 50/30/20 rule lets you enjoy discretionary spending on wants. It keeps your finances healthy and helps you reach savings and debt goals.

20%: Savings

Savings are key in the 50/30/20 budgeting rule. This 20% helps you save for the future. It's for building an emergency fund, retirement, or other investments.

Setting aside income for savings is vital. It helps you handle unexpected costs and secures your future.

Importance of Savings

Keeping a good savings rate is crucial for your financial health. An emergency fund can cover three to six months of living costs. It's a safety net for job loss or medical emergencies.

Also, saving for retirement is important. Contributions to 401(k)s or IRAs prepare you for a comfortable retirement.

Savings let you chase your dreams and invest in your future. Whether it's starting a business, going back to school, or taking a vacation, savings give you the freedom to make choices.

The 20% savings in the 50/30/20 rule is a powerful tool for financial stability. By focusing on savings, you prepare your finances for life's challenges. This helps you reach your goals.

Benefits of the 50/30/20 Budget Rule

The 50/30/20 budget rule is a simple yet effective way to manage your money. It divides your income into three parts: 50% for needs, 30% for wants, and 20% for savings. This method offers several benefits that can lead to financial success.

Ease of Use

This rule is easy to follow. Its three-part structure makes it simple, even for those new to budgeting. It helps you see where your money goes and make changes easily.

Better Money Management

The 50/30/20 rule promotes a balanced way of spending and saving. It sets aside specific amounts for each category. This helps you avoid spending too much in one area and improves your financial discipline.

Prioritization of Vital Expenses

This rule focuses on essential expenses first. It allocates 50% of your income to needs like rent and utilities. This ensures you cover your most important financial needs before spending on other things.

In summary, the 50/30/20 budget rule is a simple, flexible, and effective way to manage your finances. It helps you balance your spending and saving, leading to financial stability and success.

How to Adopt the 50/30/20 Budget Rule

To start using the 50/30/20 budget rule, you need to follow a few key steps. First, track your spending for a month or two. This helps you see how your current spending matches the 50/30/20 rule.

Understand Your Income

Then, figure out your after-tax income. This is the base for your budget. The 50/30/20 rule divides your income into three parts: 50% for needs, 30% for wants, and 20% for savings.

Identify Your Critical Costs

Next, list your essential costs like rent, utilities, and debt payments. These should not exceed 50% of your after-tax income.

Track Your Expenses

Tracking your spending helps you understand where your money goes. It shows you where to cut back on non-essential spending. This way, you can stick to the 30% "wants" category.

Automate Your Savings

Automate your savings by setting up automatic transfers to savings accounts. This ensures you save 20% of your income. It helps you avoid overspending and keeps your savings goals in focus.

By following these steps, you can adopt the 50/30/20 budget rule. It's all about finding a balance that fits your financial situation and goals.

The 50/30/20 Budget Rule Explained With Examples

The 50/30/20 budget rule is a simple way to manage money. It divides your after-tax income into three parts: 50% for needs, 30% for wants, and 20% for savings and debt.

Let's look at Bo, a recent college graduate with a $3,500 monthly income. Bo uses the 50/30/20 rule. They spend $1,750 (50%) on needs like rent and groceries. They spend $1,050 (30%) on wants, like dining out. And they save $700 (20%) for the future.

This rule helps Bo manage their personal finance well. It's a simple way to budget and save for the future.

But, the 50/30/20 rule might not fit everyone. Your income, expenses, and debts can change how you budget. It's a good starting point, but adjust it to fit your money management needs.

The 50/30/20 budget rule is a great way to manage money. It helps find a balance between spending and saving. By using this rule, you can take charge of your finances and aim for a secure future.

Adjusting the 50/30/20 Budget Rule

The 50/30/20 budget rule is a good start for managing money, but it might need tweaking. Your income and where you live can change how you split your budget. This affects your spending on needs, wants, and savings.

For example, if you live in a pricey area, you might spend more on needs. This leaves less for wants and savings. If you earn less, sticking to the 50/30/20 rule might be tough. You might need to adjust the numbers.

It's important to find a budget that fits your life and goals. You might need to change the percentages or how you categorize expenses. This way, you can still follow the 50/30/20 rule but make it work for you.

| Net Monthly Income | Needs (50%) | Wants (30%) | Savings (20%) |

|---|---|---|---|

| $2,000 | $1,000 | $600 | $400 |

| $3,000 | $1,500 | $900 | $600 |

| $4,000 | $2,000 | $1,200 | $800 |

| $5,000 | $2,500 | $1,500 | $1,000 |

Tracking your spending and income can help you fine-tune your budget. This ensures your spending matches your financial goals. Online tools can make budgeting easier and give you a clear picture of your finances.

The 50/30/20 rule is just a starting point. It's meant to be flexible to fit your specific situation. Being able to adjust it can help you stay financially stable and reach your personal finance goals.

Conclusion

The 50/30/20 budget rule is simple and effective for managing money. It helps you divide your income into needs, wants, and savings. This rule offers a balanced way to handle your finances.

Adjusting the percentages based on your situation is okay. The 50/30/20 rule works for people at all stages of their financial life. It helps you focus on what's important and save for the future.

Using this rule makes budgeting easier. It groups your income into clear categories. This makes planning your finances less stressful and more straightforward.

The 50/30/20 rule helps you balance today's needs with tomorrow's goals. It can reduce stress, help you build wealth, and prevent debt. It's a great tool for anyone looking to improve their financial health.

FAQ

What is the 50/30/20 budget rule?

The 50/30/20 budget rule is a simple way to manage your money. It splits your after-tax income into three parts. 50% goes to needs, 30% to wants, and 20% to savings.

What are the key takeaways of the 50/30/20 budget rule?

The 50/30/20 rule helps you understand the importance of needs, wants, and savings. It also shows you can adjust the percentages to fit your life.

How are the three categories of the 50/30/20 budget rule defined?

Your after-tax income is divided into three parts. 50% is for needs like rent and groceries. 30% is for wants like dining out. And 20% goes to savings for emergencies and retirement.

What are some examples of needs under the 50/30/20 budget rule?

Needs include rent, car payments, groceries, insurance, and utilities. These are essential expenses.

What are some examples of wants under the 50/30/20 budget rule?

Wants include dining out, entertainment, and vacations. These are non-essential purchases.

Why is the 20% savings allocation important in the 50/30/20 budget rule?

Saving 20% helps build financial security. It's for emergency funds, retirement, and other long-term goals.

What are the benefits of the 50/30/20 budget rule?

The 50/30/20 rule makes managing money easier. It prioritizes essential expenses while allowing for discretionary spending and savings.

How can you adopt the 50/30/20 budget rule?

Start by tracking your expenses and understanding your income. Identify your essential costs. Then, automate your savings to reach your 20% goal.

How can you adjust the 50/30/20 budget rule based on individual circumstances?

The 50/30/20 rule is a starting point. Adjust it based on your income and living costs. Find a budget that suits your financial situation and goals.