Did you know the average American household spends $72,967 a year? This is a 9% jump from last year, says the U.S. Bureau of Labor Statistics. Knowing your monthly cash flow is key to managing your money and planning to invest. By looking at your income and expenses and Understanding Personal Finance Cash Flow, you can see where you stand financially and find ways to improve your cash flow.

First, figure out your monthly net income. This is what you take home after taxes. It includes your salary, any extra jobs, and other steady income. Next, check your monthly bills like rent, car payments, loans, and credit cards. Also, think about groceries, utilities, and fun money. The amount left over is what you can use for investing.

If you spend more than you make, you need to cut costs. You might reduce what you spend on fun things, pay off debt, or get advice from a financial expert. But if you spend almost as much as you earn, you might not be ready to invest yet. The goal is to have more money coming in than going out, so you can save and invest.

Key Takeaways

- Calculating your monthly net income is the first step in understanding your personal finance cash flow.

- Analyze your average monthly expenses, including housing, food, transportation, loans, insurance, and discretionary spending.

- Ensure that your net income exceeds your expenses, leaving you with surplus funds for investment planning.

- Seek ways to reduce expenses, such as cutting luxuries or refinancing debt, if your cash flow is negative.

- Utilize a budget to track income, regulate spending, and prioritize saving to optimize your cash flow.

Calculating Your Monthly Cash Flow

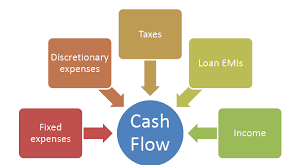

Understanding your personal finance cash flow is key to managing your money well. Cash flow is the difference between what you earn and what you spend each month. By watching your income and expenses closely, you can find a balance.

Income Sources

First, list all the ways you make money. This includes your main job, side gigs, investments, and any rental income. Tracking all your income helps you see how much money comes in each month.

Expense Categories

Then, sort your monthly costs. This includes fixed expenses like rent or mortgage, and variable costs like food and fun. Tracking your spending for three months gives a clear picture of your spending habits.

Balancing Income and Expenses

To keep your cash flow in check, compare your income to your expenses. The 50-30-20 rule helps. It says to spend 50% on needs, 30% on wants, and 20% on savings or debt. This rule helps keep your spending in line with your financial goals.

By keeping an eye on your cash flow, cutting back on unnecessary spending, and boosting your income, you can achieve financial stability. This will help you meet your long-term financial goals.

| Income Source | Monthly Amount |

|---|---|

| Salary | $5,000 |

| Rental Income | $1,500 |

| Investment Earnings | $750 |

| Total Monthly Income | $7,250 |

"Improving your cash flow requires a long-term plan and consistent effort. It's not a one-time fix, but a journey towards financial stability and growth."

The Importance of Cash Flow Management

Managing cash flow is key for both individuals and businesses. It helps avoid financial troubles and plans for the future. Knowing how cash flow works is vital for your financial health.

Avoiding Financial Pitfalls

Cash flow issues can lead to debt, harming your credit and finances. Tackling these problems early can prevent big financial issues. Good cash flow lets you pay bills and avoid extra fees.

Planning for the Future

Good cash flow means better money choices and future plans. It lets you invest, save for big buys, or aim for financial freedom. It also helps you handle life's surprises and reach your goals.

"Cash flow is the oxygen of a business. Without it, you suffocate and die."

In summary, cash flow management is very important. It helps you avoid financial problems, plan for the future, and achieve financial stability and freedom.

Creating a Personal Cash Flow Statement

Understanding your personal cash flow is key to financial stability and reaching your goals. A personal cash flow statement helps you track your income and expenses. It shows your net cash flow for a certain time.

Cash Inflows

Cash inflows include your main income sources like salaries or freelance work. You also get cash from savings interest, investment dividends, and selling financial assets.

Cash Outflows

Cash outflows cover all your expenses. This includes rent, bills, groceries, gas, and entertainment. Tracking these helps you see where you can cut costs.

Net Cash Flow

To find your net cash flow, subtract your outflows from your inflows. A positive net cash flow means you earned more than you spent. You have money left over. A negative net cash flow means you spent more than you earned. This could lead to debt or using up your savings.

| Cash Flow Scenario | Outcome |

|---|---|

| Positive Net Cash Flow | Surplus funds available for saving or investment |

| Negative Net Cash Flow | Potential for increased debt or depletion of savings |

| Net Neutral Cash Flow | Income equals expenses, no surplus or deficit |

Creating a personal cash flow statement offers deep insights into your finances. It helps you make better choices about spending, saving, and investing.

Developing a Personal Balance Sheet

A personal balance sheet is a key tool for understanding your finances. It shows your assets, liabilities, and net worth. This gives you a clear view of your wealth at a certain time. By developing a personal balance sheet, you can understand your financial health better. This helps you make smart money decisions.

Categorizing Assets

Assets are things you own that have value. They fall into three main types:

- Liquid assets: Cash, checking accounts, and savings accounts.

- Large assets: Real estate, vehicles, and valuable items.

- Investments: Stocks, bonds, and retirement accounts.

Listing Liabilities

Liabilities are debts and financial duties you have. These include:

- Credit card balances

- Personal loans

- Student loans

- Mortgages

- Other outstanding debts

Calculating Net Worth

Your net worth is what you own minus what you owe. It shows your financial health. To find your net worth, subtract your total liabilities from your total assets.

| Total Assets | Total Liabilities | Net Worth |

|---|---|---|

| $548,900 | $364,900 | $184,000 |

By categorizing your assets, listing your liabilities, and calculating your net worth, you get a full picture of your finances. This info is crucial for making smart financial choices. It helps you reach your financial goals.

"A personal balance sheet can show whether you have a positive or negative net worth."

Budgeting Strategies for Cash Flow Optimization

Keeping a healthy cash flow is key for financial stability. The 50-30-20 rule is a great strategy. It says to spend 50% on needs, 30% on wants, and 20% on savings and debt.

This rule helps balance your spending and saving. It makes sure you cover your basics and save for the future.

Another strategy is to trim expenses. Look at your monthly bills and find ways to cut costs. This could mean canceling subscriptions or finding cheaper internet plans.

Even small savings can add up. These savings can then go towards paying off debts or building your emergency fund.

Don't wait until the end of the month to save. Instead, pay yourself first. Set up automatic transfers to a savings account. This way, you save before you spend.

Using these strategies can improve your cash flow. Remember, sticking to a budget is crucial for long-term financial success.

Understanding Personal Finance Cash Flow

Personal financial statements help you track your spending and aim to increase your net worth. These statements are connected. Your net cash flow, shown in the cash flow statement, is key to growing your net worth.

Having a positive net cash flow lets you use extra money for assets or to pay off debts. This smart use of cash flow can boost your assets or reduce your debts without more debt.

It's important to understand how cash flow and net worth relate. This knowledge helps you make better financial choices and reach your goals. By watching your cash in and out, you can find ways to spend better and improve your financial health.

| Cash Flow Measure | Description |

|---|---|

| Free Cash Flow (FCF) | The cash left over after a company has paid its expenses and capital expenditures, indicating its profitability and financial flexibility. |

| Unlevered Free Cash Flow (UFCF) | The cash flow available to a company's all investors, including both debt and equity holders, before the effects of financing. |

| Cash Flow to Net Income Ratio | A measure of the quality of a company's earnings, comparing its cash flow from operations to its net income. |

| Current Liability Coverage Ratio | The ratio of a company's cash flow from operations to its current liabilities, indicating its ability to pay short-term obligations. |

| Price to Cash Flow Ratio | A valuation metric that compares a company's stock price to its cash flow per share, useful for evaluating stocks with positive cash flow but no profitability. |

By grasping the details of personal finance cash flow, you can make smarter choices. This leads to financial stability and helps you reach your long-term goals with confidence and control.

Debt Management and Cash Flow

Keeping a good cash flow is key to managing your money well. A big part of this is handling your debt right. Debt, like credit card balances and loans, can really affect your monthly money if not managed well.

Debt Avalanche Method

The debt avalanche method is a popular way to tackle debt. It means paying off the debt with the highest interest rate first. While you make the minimum payments on other debts. This way, you save the most on interest and get debt-free faster.

Debt Snowball Method

The debt snowball method focuses on the smallest debts first, no matter the interest rate. This method gives you a quick win, as you pay off each debt one by one. After paying off the smallest debt, you use that money for the next smallest debt, and so on.

Both methods can help manage debt and boost your cash flow. The best one for you depends on your financial situation and goals. Talking to a financial advisor can help pick the right strategy for you.

"Effective debt management is a key component of maintaining a healthy cash flow and achieving long-term financial stability."

By looking at your debt, setting priorities, and using a smart plan, you can control your finances. This improves your cash flow. It also gives you the flexibility to handle unexpected costs and reach your financial goals.

Increasing Assets and Decreasing Liabilities

Your net worth is key to your financial health. It shows the difference between what you own and what you owe. To get better financially, focus on increasing your assets and decreasing your liabilities.

Assets are what you own, like cash, savings, and investments. Growing your assets makes your financial situation stronger. Liabilities, on the other hand, are what you owe, like mortgages and car loans. Cutting down on liabilities can help you save money and boost your net worth.

- Work on increasing your liquid assets, like cash and investments, for more financial freedom.

- Invest in things that can grow in value, like real estate or stocks, to increase your wealth.

- Focus on paying off debts with high interest rates, like credit cards, to save money and free up funds.

- Look into ways to refinance or consolidate loans to lower your interest rates and make managing debt easier.

By managing your assets and liabilities well, you can improve your financial health. This will help you reach your long-term financial goals.

"The secret to wealth is simple: Spend less than you earn, and invest the difference." - Thomas J. Stanley

The goal is to have more assets than liabilities, leading to a positive net worth. This provides financial security and flexibility. With a smart plan for growing assets and reducing liabilities, you can improve your financial situation and look forward to a better future.

Integrating Cash Flow and Net Worth

Understanding your cash flow and net worth is key to good finances. These two important ideas help you see how well you're doing financially.

Your net cash flow is how much money you have left after paying for things. If you have more money coming in than going out, you can grow your net worth. But if you spend more than you make, your net worth might go down.

| Key Metrics | Description |

|---|---|

| Cash Flow | The movement of money in and out of your personal finances, including operating, investing, and financing activities. |

| Net Worth | The total value of your assets minus your liabilities, representing your overall financial position. |

Watching your cash flow and net worth helps you make better money choices. This can lead to buying a home, saving for retirement, or reaching financial freedom. The Cashflow and Net Worth Analysis Workbook helps you understand these important money topics better.

Understanding Personal Finance Cash Flow. The workbook makes it easy to keep track of your money. You can see how your cash flow and net worth are connected. It also helps you stay on top of your finances, so you can reach your money goals.

Conclusion

Understanding personal finance cash flow is key to financial success. By calculating your monthly cash flow, you can better manage your money. This helps you avoid financial problems and plan for the future.

Using your cash flow and net worth data wisely can guide your financial decisions. This is important for goals like buying a home, saving for retirement, or building wealth. It helps you make smart choices for your financial future.

Learning about personal finance cash flow is crucial for financial literacy and wealth-building. It lets you track your income and expenses effectively. This way, you can improve your financial health and secure your future.

Understanding Personal Finance Cash Flow. With the right tools and strategies, you can handle personal finance challenges. This approach helps you reach your financial dreams. It's all about making smart financial choices.

The power of personal finance cash flow gives you a clear view of your financial health. It helps you make better decisions and avoid financial traps. This leads to a more prosperous and secure financial future.

Understanding Personal Finance Cash Flow. By understanding cash flow analysis, you unlock the path to financial freedom. It's a powerful tool for achieving your financial goals. Start using it today to secure your financial future.

FAQ

Where does my money go every month?

To understand where your money goes, you need to track your cash flow. Cash flow is your income minus your expenses over a month. It helps you manage your money better.

Why is cash flow management important?

Managing cash flow is key for your financial future. Being cash flow positive lets you make smart money choices. This means you can buy things without debt or try investing. But, being cash flow negative can lead to debt and harm your finances.

How do I create a personal cash flow statement?

To make a personal cash flow statement, list your income and expenses. Income includes salaries and investments. Expenses include rent and bills. Then, subtract your expenses from your income to find your net cash flow.

What information does a personal balance sheet provide?

A personal balance sheet shows your wealth at a certain time. It lists your assets and liabilities. Your net worth is the difference between what you own and what you owe. It shows your financial health.

What is the 50-30-20 budgeting rule?

The 50-30-20 rule is a budgeting strategy. It suggests spending 50% on necessities, 30% on wants, and 20% on savings. This helps manage your cash flow and reach financial goals.

How can I reduce my debt and improve my cash flow?

There are two main methods to pay off debt: the debt avalanche and the debt snowball. The debt avalanche targets high-interest rates first. The debt snowball starts with the smallest debts. Both can help improve your cash flow.

How can I increase my net worth?

To increase your net worth, grow your assets or reduce your liabilities. Use your net cash flow to buy assets or pay off debts. This is a good way to boost your net worth.

How do cash flow and net worth work together?

Your net cash flow can help increase your net worth. By using it to buy assets or pay off debts, you can grow your wealth. Watching both your cash flow and net worth helps you make better financial choices.