Welcome to your guide on exchange-traded funds. These powerful tools bundle many assets into one easy-to-trade product. This makes them a popular choice for many people building their wealth. The story of these funds in the U.S. began in 1993. That's when the SPDR S&P 500 ETF (SPY) first launched. It tracked the S&P 500 Index and changed investing for everyone. Understanding this type of investment is key for a modern portfolio. They offer unique benefits over older options. You can buy and sell them all day on the market, just like a stock.

This article will show you how an ETF works. You will learn why it is a versatile tool for your goals. We cover everything from long-term growth to quick portfolio adjustments.

Key Takeaways

- An exchange-traded fund (ETF) is a basket of securities that trades on an exchange.

- The first U.S. ETF, the SPDR S&P 500 ETF (SPY), launched in 1993.

- ETFs provide a simple way to achieve instant diversification in your portfolio.

- They trade throughout the day like individual stocks, offering flexibility.

- Understanding ETFs is crucial for building a strong, modern investment strategy.

Introduction to ETFs and Their Importance

The rise of exchange-traded funds has transformed how everyday investors approach the market. These innovative tools provide access to diversified portfolios through a single transaction. They bridge the gap between individual stock picking and traditional mutual funds.

What Are ETFs?

An exchange-traded fund is essentially a basket of various securities like stocks or bonds. Providers create these funds by purchasing the underlying assets and designing a product that tracks their performance.

When you buy shares in an ETF, you own a portion of the fund itself. You don't directly own the individual stocks or bonds within it. This structure simplifies your investment process significantly.

Why ETFs Matter for Your Portfolio

These funds offer instant diversification that would otherwise require substantial capital. You can achieve broad market exposure without purchasing hundreds of individual securities.

This makes ETFs essential building blocks for modern portfolio construction. They provide cost-effective access to various asset classes and sectors. Your investment strategy benefits from their flexibility and efficiency.

Understanding ETFs explained in simple terms

At its core, an exchange-traded fund represents a straightforward approach to diversified investing. These investment vehicles bundle various assets into a single product that trades throughout the day.

ETF structure components

This section breaks down the fundamental concepts behind these popular tools. You'll gain clarity on how they operate and what makes them unique.

A Clear Definition for Beginners

An exchange-traded fund pools together a collection of securities into one investment product. When you purchase shares of this fund, you gain exposure to all the underlying assets simultaneously.

The structure allows you to buy a piece of an entire portfolio through a single transaction. This eliminates the need to research and purchase individual stocks or bonds separately.

Key Components of an ETF

Every exchange-traded fund contains several essential elements that work together. Understanding these components helps you grasp how the fund operates.

The table below outlines the main building blocks of a typical ETF structure:

| Component | Description | Primary Function |

| Underlying Securities | The actual stocks, bonds, or other assets held by the fund | Provides the investment exposure and determines performance |

| Fund Sponsor | The financial institution that creates and manages the ETF | Oversees operations and ensures proper tracking |

| ETF Shares | Units representing fractional ownership of the entire fund | Tradable on exchanges like individual stocks |

| Tracking Index | The benchmark the fund aims to replicate | Provides the strategy and performance target |

Most funds operate as open-ended structures under SEC regulations. This means there's no limit to how many investors can participate. Your ownership represents a proportional claim on the fund's total assets.

How ETFs Work in the U.S. Market

The operational mechanics of exchange-traded funds distinguish them significantly from traditional investment vehicles. Their unique structure combines stock-like trading with fund diversification benefits.

Trading Hours and Market Dynamics

You can trade these funds on U.S. exchanges during regular market hours from 9:30 a.m. to 4 p.m. Eastern time. This means you buy and sell shares at current price levels throughout the trading day.

This intraday trading flexibility lets you respond to news and market movements immediately. Unlike mutual funds, you don't wait until the day ends to execute transactions.

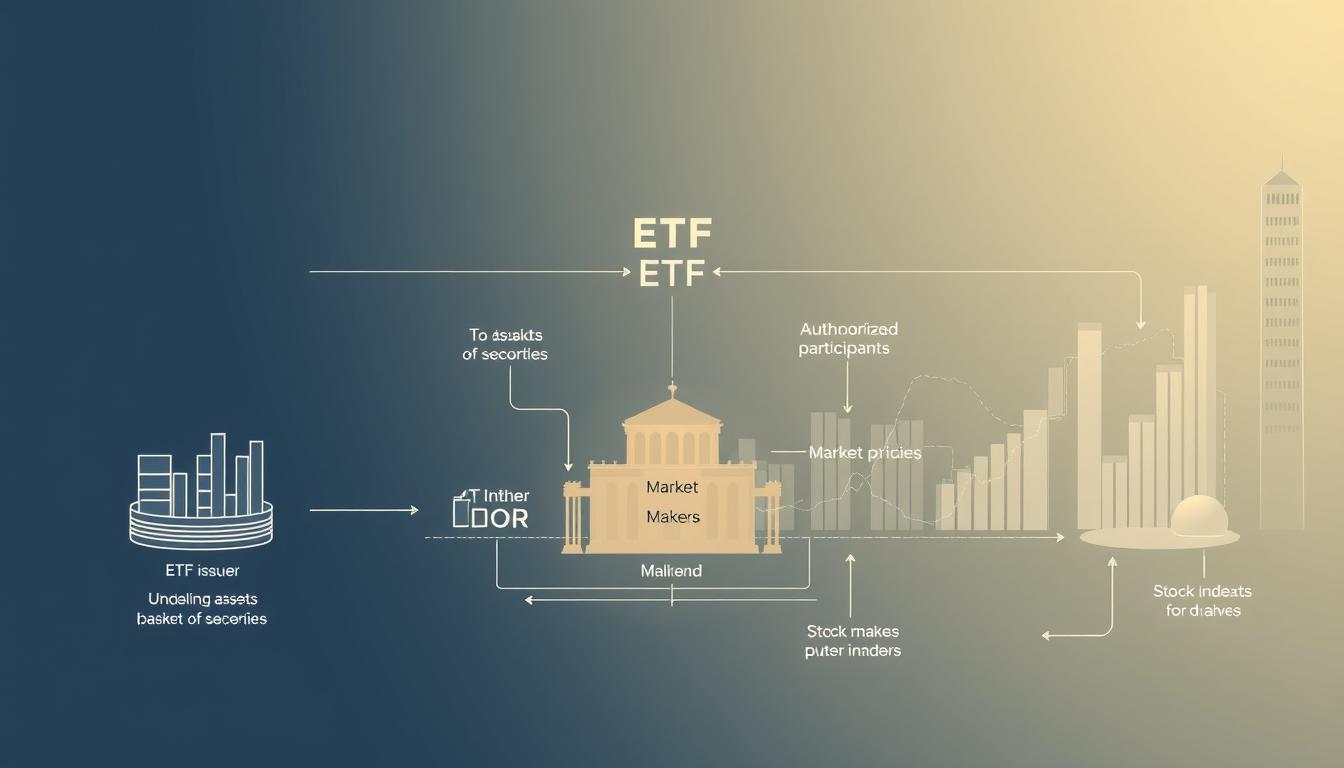

Creation and Redemption Process

The supply of fund shares adjusts through creation and redemption. Authorized participants (APs) facilitate this process to maintain price efficiency.

When demand increases, APs purchase underlying securities and exchange them for new fund shares. This creation process happens in large blocks called creation units.

Redemption works in reverse when demand decreases. APs return shares to the sponsor for underlying assets. This mechanism keeps the ETF price aligned with its net asset value throughout the trading day.

Types of ETFs: From Passive to Innovative Strategies

The investment landscape offers a diverse range of ETF types, each designed for specific goals. Understanding these different types helps you build a portfolio that matches your strategy.

Passive vs. Actively Managed ETFs

Most funds are passive. They track a specific market index, like the S&P 500. This approach offers low-cost, broad exposure.

Actively managed etf choices work differently. A portfolio manager selects securities to beat the index. This strategy typically comes with higher fees.

The table below highlights the core differences between these two primary types of etf structures.

| Feature | Passive ETF | Actively Managed ETF |

| Primary Goal | Mirror an index's performance | Outperform the market |

| Management Style | Automated, rules-based | Discretionary, hands-on |

| Cost (Expense Ratio) | Generally low | Generally higher |

| Transparency | High (holdings published daily) | Can vary (holdings may lag) |

Specialty ETFs: Bond, Commodity, Currency, and Crypto

Beyond core stock index funds, many specialty options exist. Bond etf products provide income from government or corporate bonds.

You can also access commodities like gold or oil. Currency funds track foreign exchange rates. New crypto etf choices offer exposure to digital assets.

These actively managed and thematic types etfs let you target specific commodities and sectors. They add precision to your investment approach.

Advantages of Investing in ETFs

When building your investment strategy, ETFs offer several key advantages that can significantly enhance your portfolio's performance. These benefits work together to create a powerful tool for wealth building.

The combination of features makes these funds stand out from traditional options. You gain access to professional strategies with retail-friendly simplicity.

Diversification Benefits

One major advantage is instant diversification. A single ETF purchase gives you exposure to hundreds of securities across different sectors.

This reduces concentration risk compared to owning individual stocks. Your portfolio becomes more resilient to market fluctuations.

Low Expense Ratios and Tax Efficiency

Cost efficiency represents another significant benefit. The average equity ETF charges just 0.15% annually, preserving more of your returns.

Tax advantages further enhance your investment value. Capital gains taxes only apply when you sell shares, giving you control over timing.

This structure minimizes taxable events that can erode returns. Investors benefit from keeping more of their gains over time.

These investments deliver exceptional value through their efficient design. The advantages compound to strengthen your long-term financial position.

Potential Risks and Cons of ETFs

Understanding the limitations and risks associated with ETFs helps you build a more resilient portfolio strategy. While these funds offer many benefits, they also present specific challenges that require careful evaluation.

Your total investment costs may extend beyond the expense ratio. Some brokers charge commission fees for each trading transaction. Many platforms now offer commission-free options to reduce this risk.

Trading Costs and Liquidity Concerns

Liquidity represents another important consideration. Less popular etf choices may have lower trading volumes. This can make it harder to buy or sell shares at your desired price.

The risk of fund closure exists when assets become insufficient. Administrative costs may force the sponsor to liquidate the etf. This could require you to sell positions at an unfavorable time.

Sector Concentration and Volatility

Sector-specific fund options reduce diversification benefits. They concentrate your exposure to particular industries. This increases volatility compared to broad market funds.

Some etf structures hold highly concentrated positions. A small number of holdings receive heavy weighting. This creates significant risk if those positions underperform.

The table below summarizes key risk factors to consider before investing:

| Risk Category | Potential Impact | Mitigation Strategy |

| Trading Costs | Higher transaction fees reducing returns | Choose commission-free brokers |

| Liquidity Issues | Difficulty executing trades at desired prices | Focus on high-volume funds |

| Fund Closure | Forced liquidation at unfavorable times | Select established funds with sufficient assets |

| Concentration Risk | Increased volatility from narrow focus | Combine with broader market exposure |

Actively managed options typically charge higher fees than passive funds. These additional costs can erode returns if performance doesn't justify the expense. Understanding these factors helps you make informed decisions about risk tolerance.

How to Invest in ETFs and Choose the Best Options

Your journey into ETF investing begins with selecting the right brokerage platform for your needs. Modern investors have multiple options for their account setup, from traditional broker-dealers to automated robo-advisors.

Setting Up Your Brokerage Account

Opening a brokerage account is your first step to invest etfs. You can choose online platforms or services like Betterment and Wealthfront. These platforms simplify the process for new investors.

Funding your account comes next. Many providers allow small initial investment amounts. Vanguard, for example, lets you purchase etf shares for as little as $1.

Commission-free trading has become standard on most platforms. This eliminates transaction fees that once made small purchases costly. Your investments can grow without extra charges eating into returns.

Screening Tools and Research Tips

Effective screening tools help you filter through thousands of fund options. These tools use criteria like expense ratios and trading volume. They narrow down choices based on your strategy.

The table below compares key features to evaluate when selecting an ETF:

| Research Factor | Why It Matters | Ideal Range |

| Expense Ratio | Annual cost as percentage of assets | Below 0.20% for broad market funds |

| Trading Volume | Indicates liquidity and ease of trading | 100,000+ shares daily average |

| Tracking Error | How closely fund follows its index | Consistently below 0.10% |

| Assets Under Management | Shows fund stability and popularity | $100 million minimum for established funds |

Always examine the fund's underlying holdings and strategy. Ensure it aligns with your risk tolerance and goals. Proper research helps you make informed etf selections.

ETFs vs. Mutual Funds and Stocks

The modern investor faces a choice between several investment structures. Each has unique characteristics that affect costs, trading flexibility, and ownership rights.

Cost and Fee Comparisons

Expense ratios show a clear difference between these investment types. Equity etfs average 0.15%, while equity mutual funds average 0.42%.

Individual stocks don't have expense ratios but may involve trading commissions. Most platforms now offer commission-free trading for all three options.

| Feature | ETFs | Mutual Funds | Stocks |

| Pricing Mechanism | Market price (may differ from NAV) | Net Asset Value (NAV) | Market price |

| Trading Frequency | Throughout trading day | Once daily at market close | Throughout trading day |

| Typical Expense Ratio | 0.15% | 0.42% | N/A |

| Ownership Structure | Shares of fund holding securities | Shares of fund owning securities | Direct ownership of company |

Liquidity and Trading Differences

Trading flexibility represents another key difference. ETFs and stocks trade continuously during market hours.

Mutual funds only execute trades once daily after market close. This affects your ability to respond quickly to market movements.

Ownership structures also vary significantly. With stocks, you directly own company shares. Mutual funds involve owning fund shares that hold the underlying assets.

ETFs combine aspects of both, trading like stocks while providing fund-like diversification. Understanding these distinctions helps you choose the right vehicle for your strategy.

Navigating Fees, Trading Costs, and Tax Benefits

When evaluating ETF performance, you must consider not just returns but also the impact of fees and taxes on your net gains. Understanding these financial aspects helps you maximize your investment value over time.

Understanding Expense Ratios

The expense ratio represents the annual cost of operating your fund. This fee covers management and administrative expenses. Most index-tracking options maintain low expense ratios due to passive management.

Beyond the expense ratio, you may encounter additional trading costs. These include bid-ask spreads and potential commission fees. Many brokers now offer commission-free trading to minimize these expenses.

| Fee Component | Typical Range | Impact on Returns |

| Expense Ratio | 0.03% - 0.20% | Direct annual deduction from assets |

| Trading Commissions | $0 - $10 per trade | One-time cost per transaction |

| Bid-Ask Spread | 0.01% - 0.10% | Hidden cost in share price difference |

| Account Fees | Varies by broker | Annual or quarterly maintenance charges |

Managing Capital Gains and Dividends

These investments offer significant tax advantages over traditional mutual funds. You only pay capital gains taxes when you sell your shares. This gives you control over timing your tax liability.

The unique creation mechanism makes these funds more tax-efficient. Managers can offset capital gains with losses within the fund. This potentially reduces year-end distributions to investors.

Dividend income from underlying stocks passes through to shareholders. Many brokers offer automatic reinvestment programs. This helps compound your returns over time.

Leveraging ETFs for Diversification and Portfolio Growth

The true power of exchange-traded funds emerges when you leverage them for precise industry exposure within a balanced portfolio. These tools transform how you approach market participation.

Exposure to Different Sectors and Industries

You can build a fully diversified portfolio using core funds that cover U.S. and international markets. This approach spreads risk across thousands of securities. It creates a solid foundation for long-term growth.

Sector-specific options target particular industries like technology or consumer goods. Vanguard's Consumer Staples ETF (VDC) tracks 104 different companies. It includes household names like Proctor & Gamble and Walmart.

BlackRock's iShares U.S. Technology ETF (IYW) provides access to innovation-driven tech stocks. You gain exposure to high-growth companies without picking individual winners. This strategy reduces single-stock risk.

Industry funds let you rotate between sectors during economic cycles. You might favor defensive sectors during downturns. Cyclical sectors work well during expansions.

Combining broad market funds with sector-specific choices creates a customized investment approach. Your portfolio gains both stability and growth potential. This balanced strategy aligns with your financial goals.

Expert Tips for ETF Trading Throughout the Trading Day

Unlike traditional mutual funds, ETFs offer real-time trading flexibility that savvy investors can leverage throughout market hours. This continuous trading capability opens up strategic opportunities not available with end-of-day priced investments.

Intraday Trading Strategies

Your choice of order type significantly impacts execution quality when you buy or sell shares. Different strategies suit various market conditions and investment goals.

| Order Type | Best Use Case | Key Advantage |

| Market Order | Quick execution during stable periods | Immediate trade completion |

| Limit Order | Controlling entry/exit price points | Price protection |

| Stop-Loss Order | Risk management during volatility | Automatic protection |

Market orders execute immediately at current prices. Limit orders let you set maximum purchase or minimum sale prices. Stop-loss orders automatically trigger sales when prices hit predetermined levels.

Timing Your Buys and Sells

Avoid the first and last thirty minutes of the trading day when spreads typically widen. Mid-day periods often offer better execution prices for your transactions.

Monitor the difference between an ETF's market price and its net asset value. This helps identify buying opportunities at discounts. It also prevents purchasing at significant premiums.

Disciplined timing approaches like dollar-cost averaging reduce market timing risks. Price alerts notify you when target entry or exit points are reached throughout the trading session.

Conclusion

Exchange-traded funds stand out as powerful vehicles that democratize access to sophisticated investment strategies. They provide a cost-effective pathway to building diversified portfolios with broad market exposure.

Your journey into investing benefits from the key advantages covered throughout this guide. Low expense ratios, intraday trading flexibility, and tax efficiency make these funds attractive alternatives to traditional options.

Remember to balance these benefits with proper due diligence. Consider trading costs and liquidity when selecting specific ETFs for your portfolio. This ensures your choices align with your long-term financial objectives.

Apply the knowledge gained about different fund types and screening tools. This empowers you to make informed decisions as you build wealth through these versatile investment vehicles.