If you face an unexpected bill or a major purchase, careful borrowing can bridge the gap without derailing your goals. This guide helps you match a loan to your budget, weigh total costs, and protect your credit. Start by defining what responsible borrowing means for your current situation. Choose an option that fits your timeline, understand rates and fees, and set a realistic repayment plan you can follow. Compare options like credit cards, personal loans, home equity, peer lending, and government programs. Learn why interest rates, APR, fees, and term length can make the same loan cost very different amounts over months and years. Avoid fast-cash offers such as payday lenders or illegal loan sharks. Their high interest and penalties can trap you in a cycle of rising debt and harm your credit score.

This article offers informational content, not personal financial advice. Match any decision to your goals, budget, and risk tolerance before you sign.

Key Takeaways

- Define what responsible borrowing means for your situation.

- Compare total costs, not just monthly payments.

- Protect your credit by keeping on-time payments.

- Beware of high-cost quick-loan offers.

- Match any borrowing choice to your budget and goals.

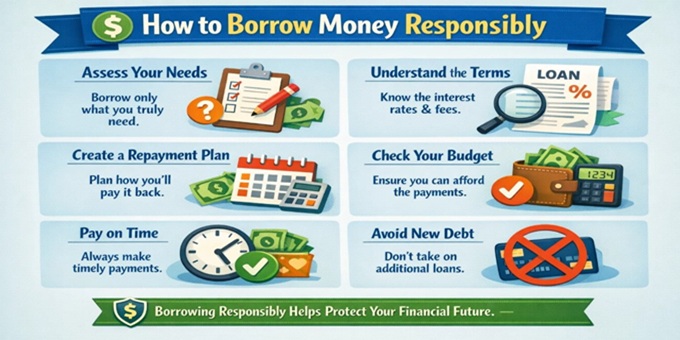

Assess your needs, goals, and budget before borrowing

Pause and list the specific expense, time frame, and outcome before seeking funds. Clarify whether your need is an emergency, a planned major expense, or debt consolidation. That decision guides which product fits your goals and what terms make sense.

Borrow only the amount you actually need. Price the real expense with quotes or bills so you avoid rounding up "just in case." A larger amount raises interest costs and can extend the time you stay in debt.

Stress-test your monthly budget. List essentials like rent, utilities, food, transportation, and insurance. Add the proposed payment and see if normal monthlies still fit.

- Decide the purpose: emergency cash, major purchase, or consolidation.

- Translate your goal into a target amount using real estimates.

- Run a pressure test: what if groceries cost more or your hours drop?

If you find yourself borrowing repeatedly for routine expenses, that signals a need to revise spending, rebuild savings, or seek a plan that stabilizes your finances. Responsible borrowing starts with what you can repay, not what a lender will approve.

How to borrow money responsibly by choosing the right borrowing option

Pick the borrowing tool that matches the size and timing of your expense rather than the flashy sales pitch.

Credit card vs. loan: For small, short-term purchases, a credit card can work if you plan to pay in full during the grace period. For larger expenses, a loan gives a fixed schedule and predictable payments that help your budget.

Secured vs. unsecured borrowing

Secured products use collateral (or a deposit for secured credit cards) and usually offer lower rates but higher risk if you miss payments. Unsecured options rely on credit history and may cost more, yet they protect assets like your home.

Common product notes

- Personal loans: fixed amount and set payments, often used for bills, repairs, or consolidation — see a concise personal loans guide.

- Credit cards: revolving accounts with changing balances; avoid carrying balances to limit interest costs.

- Home equity loans & HELOCs: lower rates but your home is collateral; one is a lump sum, the other is a line you draw from.

- Peer-to-peer: compare platform fees and protections before accepting an offer.

| Option | Best for | Rate / Cost | Main risk |

| Credit card | Small, short-term buys | Higher variable rates | Ongoing balances raise costs |

| Personal loan | Larger one-time expenses | Fixed rate possible | Origination fees |

| Home equity / HELOC | Big projects, lower rate need | Lower rates | Home at stake |

| P2P lending | Alternative funding | Platform-dependent | Platform variability |

Compare interest rates, APR, fees, and total borrowing costs

Look past the sticker rate and focus on what you will actually pay across the life of the loan. Use APR as an apples‑to‑apples benchmark, since APR blends the interest rate with many fees. For a deeper check, read the fine print to find fee triggers and timing.

APR vs. interest rate

The interest rate describes the percentage charged on the principal. APR usually reflects the interest rate plus certain fees, annualized so you can compare lenders more fairly.

See a clear explainer on APR and interest differences at APR vs. interest rate.

Fixed vs. variable rates

Fixed rates keep payments steady, which helps with monthly planning. Variable rates can start low but rise, increasing your total interest and unpredictability.

How interest accrues

Ask whether interest accrues daily or monthly and whether it compounds. Daily compounding grows the balance faster than simple interest, especially over long terms.

Fee checklist

- Origination fees on loans

- Annual fees on cards

- Closing costs for home equity products

- Late payment penalties and prepayment fees

Calculate total cost, not just monthly payments

Stretching a term cuts monthly payments but raises the total cost. Run quick what‑if comparisons: same amount with different rates, or same rate with added fees.

"A low teaser rate can be outweighed by high fees or a variable structure that raises payments later."

Evaluate lenders and protect your credit score

Use prequalification or pre‑approval tools to compare likely offers without a hard inquiry. This helps you see probable rates and terms while protecting your credit file.

Prequalification and pre‑approval

Soft checks let you compare lenders with minimal downside. Only submit full applications to the few offers that look best.

Credit history and score factors

Your credit history shapes the offers you see. A stronger score usually unlocks a lower rate and better terms, which cuts total cost and monthly payments.

Servicing and support

Customer service matters. Check autopay options, online tools, hardship policies, and how quickly a lender answers disputes.

Credit bureau reporting

Confirm the lender reports account activity to Experian, Equifax, and TransUnion. On‑time payments should build your score over time.

"Choose a lender that combines clear costs, fair terms, and reliable support — that choice protects your score and peace of mind."

- Limit full applications to avoid multiple hard inquiries.

- Read late‑payment and dispute rules before you sign.

- If declined, call for a reason or reconsideration rather than reapplying blindly.

Create a repayment plan you can follow

Set a clear repayment path before you sign any agreement. Ask when payments are due, whether the card or loan has a grace period, the full loan term, and what happens if a payment is late.

Match payments to your pay cycle

Build your repayment plan around paydays so a payment posts right after income arrives. This reduces missed payments and extra fees.

Set realistic payment amounts

Start by covering the minimums. Then add extra toward principal when you can. That strategy lowers interest and shortens payoff time.

Protect your credit with simple rules

Pay your credit card statement in full and on time whenever possible. Doing so avoids interest charges, preserves any grace period, and cuts common fees.

Automate and monitor

Use autopay for at least the minimum and set calendar reminders for the full payment amount. Automation guards your score during busy months.

"If you find yourself borrowing again before a balance is cleared, act now: adjust spending, contact your lender about hardship options, or adopt a structured payoff plan."

- Pre-signing checklist: due dates, grace period, loan term, late-payment consequences.

- Watch warning signs like re-borrowing or relying on cards for essentials.

- Corrective actions: cut discretionary spending, seek lender options, and avoid high-cost quick cash products.

Consistent payments protect your credit and free more cash for your goals. For help with structured repayment choices, see a concise guide on paying debt.

Conclusion

Conclude by focusing on the practical steps that keep borrowing aligned with your budget. Clarify your need, pick the right loan, compare total costs, check lenders, and set a clear repayment plan. Stick to the discipline: take only what you need and avoid adding new debt before old balances are handled. Keep copies of agreements and note key dates so your obligations are clear from day one. Next steps: shortlist two or three offers, prequalify where possible, calculate total cost, and pick the option you can repay without sacrificing essentials. Learn more about sensible borrowing options that protect your credit and lower long-term debt.