Imagine having a powerful visual tool that transforms your financial dreams into daily motivation. This strategic approach moves beyond traditional planning methods by creating a tangible representation of your aspirations. The SEC's Office of Investor Education and Advocacy recognizes the effectiveness of visualization techniques for future investing. This method bridges the gap between abstract financial planning and your personal objectives. Your personalized display serves as a constant reminder of why you work hard. It helps maintain focus on long-term objectives when short-term challenges arise. This technique taps into your brain's visual processing power, potentially strengthening neural pathways associated with your targets. Unlike standard budgeting tools that manage day-to-day expenses, this visual system inspires and motivates. It keeps your most important dreams

present in your daily routine. By the end of this guide, you'll have practical strategies tailored to your unique situation and personality.

Key Takeaways

- A financial vision board transforms abstract aspirations into concrete visual representations

- This tool serves as a daily reminder of your long-term financial objectives

- Visualization techniques leverage your brain's natural processing capabilities

- The approach differs from traditional budgeting by focusing on inspiration

- Personalization ensures alignment with your unique financial situation

- Regular interaction with your board strengthens motivation pathways

- This method bridges the gap between planning and tangible results

Understanding the Purpose and Benefits of a Financial Vision Board

Visual goal-setting systems convert financial aspirations into concrete visual anchors. This approach moves beyond traditional planning by creating a tangible representation of your monetary objectives.

Clarity, Focus, and Motivation

Your personalized display provides immediate clarity about what truly matters in your financial life. It eliminates confusion by forcing you to identify and prioritize your most important objectives.

The visual nature keeps your targets front and center in your consciousness. This daily focus ensures every financial decision aligns with your long-term aspirations rather than immediate impulses.

Enhancing Financial Discipline and Goal Setting

Regular interaction with your display cultivates strong financial discipline. It serves as a constant accountability partner that reminds you why you're choosing to save rather than spend.

The process improves your goal-setting abilities by requiring deep thinking about what you want to achieve. This leads to more specific and actionable financial objectives with clear timelines.

| Benefit Area | Short-Term Impact | Long-Term Value | Psychological Effect |

| Clarity & Focus | Immediate priority identification | Sustained direction alignment | Reduced decision fatigue |

| Motivation | Daily inspiration boost | Consistent drive maintenance | Emotional connection strengthening |

| Discipline | Spending habit awareness | Automated financial behaviors | Impulse control enhancement |

| Goal Achievement | Clear action steps | Measurable progress tracking | Confidence building |

How to create a financial vision board

Begin your journey toward monetary clarity by defining what prosperity truly means in your life. This initial phase transforms vague wishes into concrete objectives that guide your financial decisions.

Visualizing Your Financial Dreams and Aspirations

Start by reflecting deeply on what economic freedom represents for you personally. Consider whether it means early retirement, debt-free living, or acquiring specific assets. This introspection forms the foundation of your personalized display.

Brainstorm all your monetary objectives without limitations. Include both practical needs and ambitious dreams. The SEC's Office of Investor Education and recommends considering diverse targets like emergency funds, home ownership, and retirement planning.

Transform abstract concepts into tangible representations through symbols and imagery. A graduation cap might symbolize student loan repayment, while a tropical beach could represent vacation savings. Select visuals that evoke strong emotional connections to your targets.

| Goal Category | Example Objectives | Visual Representation Ideas | Emotional Connection |

| Debt Elimination | Pay off credit cards, student loans | Cut-up credit card, zero balance statement | Relief, freedom from burden |

| Savings Targets | Emergency fund, down payment | Piggy bank, house key, passport | Security, accomplishment |

| Investment Growth | Retirement accounts, stock portfolio | Growth chart, compound interest graphic | Confidence, future security |

| Income Generation | Side business, career advancement | Office setting, entrepreneurship symbols | Empowerment, opportunity |

Categorize your aspirations into meaningful sections for balanced coverage. Include both destination images (end results) and journey symbols (process elements). This approach creates a comprehensive roadmap for your economic future.

Choose personally resonant visuals rather than generic stock photos. Your display should reflect your unique personality and motivations. Authentic imagery strengthens the emotional impact and maintains your engagement over time.

Choosing the Right Format for Your Vision Board

The foundation of an effective goal visualization system lies in selecting a format that aligns with your lifestyle. This decision impacts how frequently you interact with your monetary objectives.

Consider your daily routine and personal preferences when evaluating options. The right choice ensures consistent engagement with your financial targets.

Physical, Digital, and Journal Options

Physical boards offer a tactile experience that many find deeply motivating. The hands-on process of cutting and arranging images helps cement goals in your mind.

These tangible displays provide constant visual reinforcement in your living or workspace. They require no digital skills but offer less flexibility for updates.

Digital vision boards provide maximum accessibility across devices. You can use platforms like Canva or Pinterest to design your visual representation and access it anywhere.

This format suits frequent travelers and tech-savvy individuals. Updates are simple, though digital clutter can sometimes reduce visibility.

Journal-based approaches combine visual elements with written reflection. This private method allows for detailed progress tracking alongside imagery.

Your format selection should match your learning style and available space. Each option serves the same purpose through different engagement methods.

Gathering Materials and Creative Resources

Collecting your creative resources marks the exciting transition from planning to actual construction. This phase transforms your monetary objectives into tangible elements that will form your personalized display.

Essential Tools and Supplies

Begin by gathering materials specific to your chosen format. For physical displays, you need a sturdy base like poster board, magazines for cutting, adhesive, and decorative elements.

Digital formats require access to design platforms and image sources. Canva offers excellent templates while Unsplash provides quality photos. Pinterest serves as great inspiration for your project.

Curating Inspiring Images, Quotes, and Symbols

Your image selection process deserves careful attention. Choose visuals that trigger genuine emotional responses connected to your financial targets.

Look for symbols representing security, freedom, and achievement. Growth charts, dream homes, and travel destinations make powerful additions. Each element should serve a specific motivational purpose.

Include meaningful words and phrases that reinforce your commitment. Terms like "Financial Freedom" or "Debt-Free Living" provide daily affirmation. Critically evaluate whether each item truly represents your personal aspirations.

Organize collected materials into categories before arranging them. Create separate groups for retirement, savings, and lifestyle objectives. This ensures balanced representation across all your financial goals.

Setting and Visualizing Your Financial Goals

Your financial future takes shape when you define concrete objectives with measurable outcomes. This process moves beyond vague wishes to establish clear targets that guide your daily decisions.

Short-Term vs. Long-Term Objectives

Distinguish between immediate targets and future aspirations. Short-term goals typically span one to three years and build your financial foundation.

These might include establishing an emergency fund or eliminating credit card debt. Long-term objectives represent your bigger financial vision, like retirement planning or home ownership.

Applying the SMART Goal Framework

Structure each target using the SMART criteria for maximum effectiveness. Ensure your goals are Specific, Measurable, Achievable, Relevant, and Time-sensitive.

This approach transforms "save more money" into "save $500 monthly for 20 months." Your financial planning becomes more intentional and results-driven.

Honestly assess your current financial situation before setting targets. This ensures your vision board reflects challenging yet attainable aspirations.

Designing, Organizing, and Displaying Your Vision Board

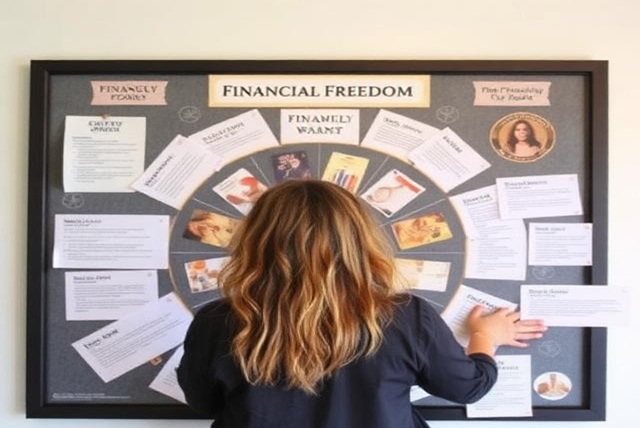

The final assembly stage transforms your collected materials into a powerful motivational tool. This is where your strategic planning becomes a tangible source of daily inspiration.

Creative Layout and Personal Touches

Arrange your images and quotes in a layout that tells the story of your financial journey. Group related objectives together or use a timeline to show progression from short-term to long-term goals.

Infuse your personality into the design. Handwritten affirmations, personal drawings, or decorative borders make the display uniquely yours. These elements strengthen your emotional connection to the targets.

Digital formats offer flexibility for easy updates and animated elements. A physical board gains power with interactive components like progress trackers. Your chosen medium should reflect your personal style.

Optimal Placement for Daily Inspiration

Position your completed display where you will see it multiple times each day. High-traffic areas like your home office or bedroom wall are ideal locations.

Consider creating multiple versions for constant reinforcement. A large board for detailed reflection, a phone wallpaper for on-the-go motivation, and a journal for private tracking ensure your goals are always present.

| Format Type | Best Placement Strategy | Unique Advantage |

| Physical Board | Home office wall, above desk | Tactile, constant visible reminder |

| Digital Board | Computer desktop, phone screensaver | Portable, easily updated |

| Vision Journal | Nightstand, personal workspace | Private, combines visuals with written reflection |

This strategic placement turns your environment into a supportive ecosystem for achieving your financial aspirations. Your next step is regular engagement with this powerful tool.

Conclusion

Your journey toward true financial freedom gains a powerful ally with this personalized visual tool. This visual representation of your aspirations transforms abstract dreams into a daily source of focus and motivation.

Remember, your vision board is a living document. Schedule regular reviews to update images as you achieve goals and your financial situation evolves. This keeps you connected to your evolving life goals.

Pair your board with concrete action. A detailed savings plan and disciplined execution turn inspiration into reality. Let your board guide decisions, ensuring choices align with your long-term goals.

Your next step is clear. Set aside time this week to create your vision board. This simple act is the first decisive move toward the financial freedom you deserve.