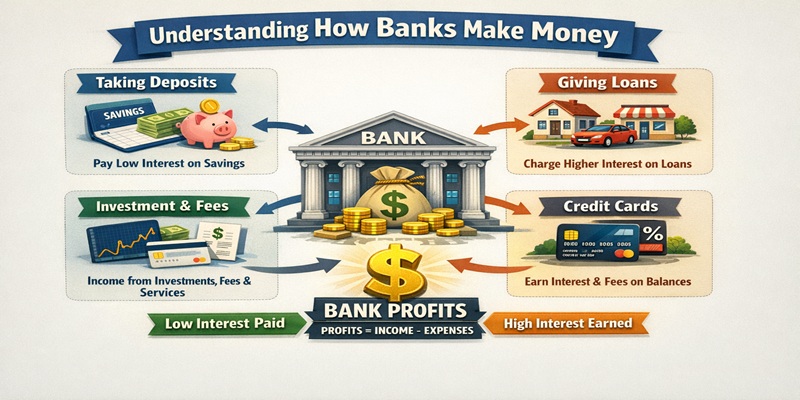

You deal with banks every day. You deposit funds, open accounts, and borrow for life goals. At the core, a bank profits by lending your deposits at higher rates than it pays you. This section gives a clear, plain-English view of what drives bank revenue. You will see the three main streams: interest income from loans, fee-based income from accounts and services, and capital markets or investment banking fees. You’ll learn why lending is the foundation of most banking firms, even when they offer trading, advisory, or payment services. You’ll also see how the same dollars support lending, liquidity, and payments at once.

Finally, get a quick preview of risks and stability: interest and fees tend to be steadier, while capital markets revenue can swing with the economy and rates. This roadmap sets expectations so you can link these revenue sources back to your accounts and borrowing costs.

Key Takeaways

- Banks earn most from the spread between lending and deposit rates.

- Three core revenue sources: interest, fees, and capital markets.

- Lending remains the central business even for diversified firms.

- One dollar can support lending, liquidity, and payment services.

- Interest and fees are generally steadier than markets income.

How Banks make Money: The core banking model you interact with every day

The money you park in checking and savings becomes the low-cost capital that supports most bank lending.

Why deposits become capital for loans and liquidity

Your deposits give a bank the capital it needs to fund loans and to clear daily payments. These balances act as a steady, low-cost pool compared with other funding sources.

How the spread between deposit and loan rates creates profit

Banks pay depositors a smaller rate than they charge borrowers. That gap—the spread—covers operating costs and creates profit. When market rates move, you’ll notice offers on accounts and loan pricing change too.

What FDIC insurance means for funding costs

FDIC protection insures deposit accounts up to $250,000 per depositor, per insured bank. That security helps banks keep funding costs lower because insured deposits are stable during stress.

Fast facts

- Your account balances support lending and daily liquidity.

- Short-term deposits can fund longer loans if liquidity is managed.

- Banks also earn from payments and account-related services beyond lending.

| Source | Role | Impact on cost |

| Checking & savings | Low-cost capital | Reduces funding rate |

| Time deposits (CDs) | Stable term funding | Moderate cost |

| Wholesale markets | Supplemental liquidity | Higher cost |

For a deeper look at industry mechanics and examples of pricing, see how banks make money.

Interest income: Where most bank revenue starts

Interest income is the primary line item you’ll see on most commercial bank statements. It reflects the gap between what a lender charges on loans and what it pays on deposits.

Net interest margin and the spread

Net interest margin measures that spread. When loan rates exceed deposit rates, the margin grows. If rates move, margins can widen or compress quickly.

Mortgage lending and consumer loans

Mortgages often make up the largest share of consumer lending. Long terms and collateral push pricing lower per dollar but earn steady income over decades.

Auto loans and secured consumer credit

Auto loans have shorter terms and higher rates. Competition from manufacturer finance arms affects pricing and approval standards.

Credit cards and revolving credit

Credit cards are revolving and carry higher default risk. That risk leads to higher rates and extra fee income for lenders.

Business lending and credit risk

Business loans and lines of credit support working capital and growth. Strong underwriting and monitoring reduce default risk and protect interest revenue.

For a practical primer on reported interest figures, see interest income mechanics.

Fee-based income: Stable money from banking services and products

Non-interest charges tied to routine accounts and cards provide a reliable revenue stream. That stability matters when lending margins tighten and markets swing.

Account and service charges include monthly maintenance, minimum-balance and overdraft fees. You may also see NSF or safe-deposit box fees. These charges trigger when account behavior falls outside plan rules.

Card and transaction charges

Beyond interest, a credit card generates late-payment and transaction fees. Merchants pay interchange on card sales, and a portion of that becomes revenue for the issuer and networks.

Wealth and investment management

Advisory and management fees are recurring. Mutual fund revenue can appear inside pooled products as expense ratios. These fees scale with assets under management and deepen customer relationships.

Why it matters to you: banks bundle products and often waive fees for certain balances to encourage loyalty. Evaluate trade-offs: a “free” account may cost more in transaction fees than a low-fee premium plan.

For a practical guide to fee drivers, see how fees drive bank revenue.

Capital markets and investment banking income: Big fees, higher volatility

Investment teams help companies tap capital, creating sizable but volatile revenue streams.

What sets this work apart from lending is scale and timing. Underwriting and advisory fees come in large lumps. They depend on deal flow and market sentiment, so they rise in expansions and fall in downturns.

Sales and trading as client services

Sales and trading desks execute orders for investors and provide liquidity to the market. They serve clients by sourcing buyers and sellers, not just placing proprietary bets.

Underwriting debt and equity

Underwriting means banks help companies issue debt or equity. A typical process: assess demand, set price, buy the shares or bonds, then sell them to investors. Underwriting fees reward that risk and effort.

M&A advisory and deal drivers

M&A teams advise on strategy, valuation, and negotiation. Advisory fees tie to deal size and success. Deal volume tracks interest rates, risk appetite, and volatility, which explains the cyclical nature of this revenue.

Who uses these services is mostly large companies and institutional investors. You feel the effects indirectly when corporate activity supports jobs, investment, and wider economic growth. For an example of market-driven gains, see record earnings from market volatility.

What changes bank revenue today: rates, regulation, and digital banking

Markets, rules, and technology shape the way banks earn and how you experience accounts and services.

Why deposit “float” often means low yields for you

Your deposits fund a bank’s day-to-day work. Banks earn on those funds and often pay depositors far less than that earning rate. That difference is the float, and it adds up when millions of accounts hold small gaps in yield.

Because float scales across many customers, banks can preserve margin while still offering basic services at low visible cost.

Reserve rules and the credit creation mechanism

Regulators require banks to hold capital and reserves as cushions. Those rules limit how much of your deposit pool can be lent out.

Credit creation is simple in concept: when a bank lends, new deposits often appear elsewhere in the system, expanding the money supply. Reserve and capital limits control that expansion and influence lending capacity.

Online banks vs brick-and-mortar: cost and pricing differences

Online banks avoid branch rents and staffing costs. That lower overhead lets many digital banks offer higher promotional APYs or lower fees.

Traditional banks use branches for service and relationships, which raises operating cost. Those costs show up in slightly lower rates, different fee schedules, or higher account minimums.

| Feature | Online banks | Traditional banks |

| Operating cost | Lower (no branch network) | Higher (branches, staff) |

| Typical APYs | Often higher on savings/promos | Moderate, variable by relationship |

| Fees and account minimums | Lower or digital-first fees | More fee tiers, branch service fees |

| Access and trust signals | Strong apps; fewer in-person options | Branch access; wider physical presence |

What changes for you: watch fee schedules, promotional rates, and credit terms as interest cycles shift. FDIC insurance and clear disclosures still guide safety and choice.

Conclusion

Think of a bank as a hub: deposits arrive, credit moves out, and fee and investment activity fill the gaps. In short: primary revenue streams are lending spreads, fee-based services, and investment banking deals. Fee income tends to stay steady while market-driven deals swing with the economic cycle. For your decisions, watch deposit rates, total borrowing costs, and account terms. Those three signals show where profit pressure sits and how it affects customers and businesses. Use this view to read headlines and compare products. Understanding these revenue drivers helps you pick accounts, manage credit, and judge risk when investment activity heats up or cools down.